KUALA LUMPUR (March 21): Bursa Malaysia ended marginally higher on Tuesday (March 21) on bargain hunting in selective heavyweights and in line with most regional markets.

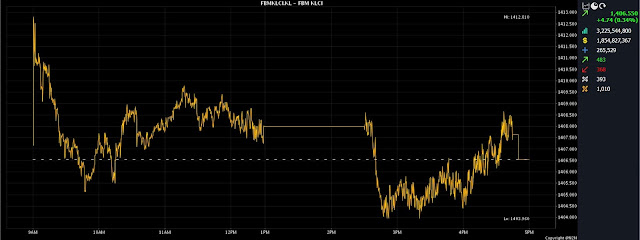

At 5pm, the benchmark FTSE Bursa Malaysia KLCI (FBM KLCI) rose 4.74 points, or 0.34%, to 1,406.55 from Monday’s close of 1,401.81.

The market bellwether opened 5.35 points higher at 1,407.16 and moved between 1,403.96 and 1,412.81 throughout the day.

Turnover eased to 3.23 billion units worth RM1.85 billion against Monday’s 3.47 billion units worth RM1.93 billion.

“Despite the improvement in global market sentiment, we prefer to stay cautious as we reckon market volatility would stay high in the near term although the benchmark index remained in oversold position,” Rakuten Trade Sdn Bhd vice-president of equity research Thong Pak Leng told Bernama.

He expects the FBM KLCI to move in rangebound trading, hovering within the 1,400-1,415 range for the remainder of the week.

“On a technical point of view, the immediate support is seen at 1,400 followed by 1,390 while support is at 1,420,” he said.

Regionally, the Singapore’s Straits Times Index garnered 1.25% to 3,179.02, Hong Kong’s Hang Seng Index chalked up 1.36% to 19,258.76, China’s SSE Composite Index put on 0.64% to 3,255.65, while South Korea’s Kospi rose 0.38% to 2,388.35.

Back home, Bursa Malaysia heavyweights, Malayan Banking Bhd advanced six sen to RM8.40, Public Bank Bhd improved by four sen to RM3.99, CIMB Group Holdings Bhd rose four sen to RM5.19, Tenaga Nasional Bhd was flat at RM9.47, Petronas Chemicals Group Bhd dipped 18 sen to RM6.82, and Hong Leong Bank Bhd lost 10 sen to RM20.

Among the actives, Top Glove Corp Bhd increased 5.5 sen to 96 sen, Careplus Group Bhd increased four sen to 31.5 sen, Malaysia Building Society Bhd climbed 1.5 sen to 66 sen, Velesto Energy Bhd was up one sen to 20 sen, while Zen Tech International Bhd edged down half-a-sen to 2.5 sen, and Hong Seng Consolidated Bhd slipped half-a-sen to 13.5 sen.

On the index board, the FBM Emas Index was 41.67 points higher at 10,290.78, the FBM 70 Index was 78.56 points firmer at 13,290.45, and the FBMT 100 Index increased 39.82 points to 9,987.33.

The FBM Emas Shariah Index went up 31.97 points to 10,618.28, and the FBM ACE Index climbed 42.32 points to 5,261.05.

Sector-wise, the Financial Services Index rose 80.06 points to 15,534.08, the Energy Index rose 10.02 points to 795.23, the Plantation Index decreased by 28.15 points to 6,752.32, and the Industrial Products and Services Index shed 0.53 of-a-point to 167.01.

The Main Market volume shrank to 2.07 billion shares worth RM1.59 billion from 2.28 billion shares worth RM1.66 billion on Monday.

Warrants turnover dwindled to 358.33 million units worth RM61.74 million from 550.98 million units worth RM86.67 million.

The ACE Market volume expanded to 778.95 million shares worth RM201.03 million from 633.67 million shares worth RM182.64 million previously.

Consumer products and services counters accounted for 322.51 million shares traded on the Main Market, industrial products and services (320.06 million), construction (37.14 million), technology (359.44 million), SPAC (nil), financial services (98.58 million), property (98.8 million), plantation (22.49 million), REITs (5.71 million), closed/fund (nil), energy (147.19 million), healthcare (361.24 million), telecommunications and media (244.87 million), transportation and logistics (26.41 million), and utilities (25.61 million).

Source: The Edge

Comments

Post a Comment