KUALA LUMPUR (March 9): Bursa Malaysia closed on a softer note despite Bank Negara Malaysia’s (BNM) decision to retain the overnight policy rate (OPR) on Thursday (March 9), as investors remained wary of interest rate hikes in the US and risk of a recession on the global scale.

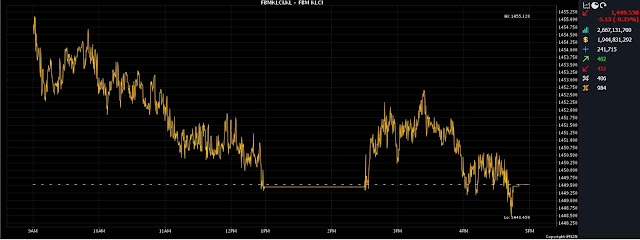

At 5pm, the benchmark FBM KLCI had slipped 5.13 points to 1,449.53, from Wednesday's closing at 1,454.66.

The key index opened 0.16 of a point higher at 1,454.82, and moved between 1,448.45 and 1,455.12 throughout the day.

Turnover amounted to 2.66 billion units worth RM1.94 billion.

Rakuten Trade Sdn Bhd vice-president of equity research Thong Pak Leng said the KLCI continued to trend lower after a lacklustre trading session with key regional markets mostly in negative territory.

However, back home, he reckoned that market sentiment should improve slightly as BNM maintained the OPR at 2.75%.

The central bank kept the key rate unchanged at 2.75% for a second consecutive time after making a cumulative 100-basis-point hike since May 2022.

“On the other hand, investors should stay alert on increasing market volatility and external uncertainties.

“As such, we expect the KLCI to trend sideways with an upside bias within the 1,450-1,470 level towards the weekend,” he told Bernama.

Bursa heavyweight Sime Darby Plantation Bhd declined 17 sen to RM4.30, Press Metal Aluminium Holdings Bhd shed one sen to RM5.10, IOI Corp Bhd decreased seven sen to RM3.89, while Maxis Bhd added three sen to RM4.02.

The Financial Services Index, meanwhile, rose 8.44 points to 16,114.00. Among banking stocks, Malayan Banking Bhd (Maybank) rose four sen to RM8.71, Public Bank Bhd increased two sen to RM4.13, CIMB Group Holdings Bhd decreased seven sen to RM5.50, and Hong Leong Bank Bhd eased four sen to RM20.52.

As for the active counters, Astro Malaysia Holdings Bhd shed six sen to 67 sen, VinVest Capital Holdings Bhd was flat at 22.5 sen, Top Glove Corp Bhd increased four sen to 71.5 sen, while Careplus Group Bhd at 26 sen and BSL Corp Bhd at 13 sen had risen 1.5 sen each.

On the index board, the FBM Emas Index fell 33.24 points to 10,572.51, the FBMT 100 Index dwindled 34.09 points to 10,249.25, the FBM Emas Shariah Index trimmed 48.60 points to 10,810.18, the FBM ACE Index was 8.96 points lower at 5,446.60, and the FBM 70 Index gave up 35.29 points to 13,453.67.

Sector-wise, the Energy Index declined 7.51 points to 883.09, the Plantation Index sank 109.50 points to 6,829.93, and the Industrial Products and Services Index eased 1.39 points to 175.83.

The Main Market volume shrank to 1.74 billion shares worth RM1.64 billion, from Wednesday's 2.81 billion shares worth RM1.97 billion.

Warrant turnover dipped to 247.91 million units worth RM39.35 million, from 355.55 million units worth RM61.35 million previously.

The ACE Market volume expanded to 668.78 million shares worth RM261.42 million, from 590.55 million shares worth RM255.46 million.

Consumer product and service counters accounted for 252.53 million shares traded on the Main Market, followed by industrial products and services (431.43 million), construction (66.38 million), technology (191.32 million), special purpose acquisition companies (nil), financial services (51.78 million), property (99.45 million), plantation (31.22 million), real estate investment trusts (9.97 million), closed/funds (4,700), energy (106.86 million), healthcare (245.00 million), telecommunications and media (119.55 million), transportation and logistics (30.08 million), and utilities (113.07 million).

Source: The Edge

Comments

Post a Comment