KUALA LUMPUR (Oct 30): Bursa Malaysia closed marginally lower on Monday amid regional markets’ mixed performance, a dealer said.

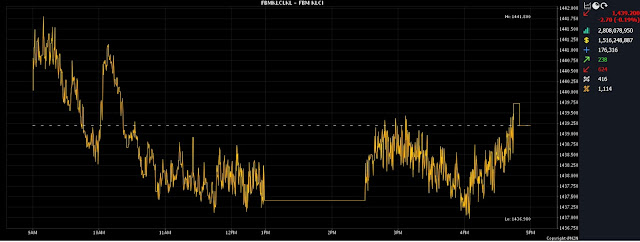

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) decreased 2.7 points to 1,439.2 from last Friday's (Oct 27) closing of 1,441.9.

The benchmark index, which opened 1.86 points lower at 1,440.04, moved between 1,436.98 and 1,441.8 throughout the day.

On the broader market, decliners outpaced gainers 624 to 238, while 416 counters were unchanged, 1,114 untraded and 76 suspended.

Turnover increased to 2.8 billion units valued at RM1.51 billion from 2.72 billion units worth RM1.69 billion on Friday.

Rakuten Trade Sdn Bhd equity research vice president Thong Pak Leng said key regional indices ended mixed as cautious sentiments emerged while investors brace themselves for a data-packed week, with the US Federal Reserve taking the spotlight on account of its policy meeting this week.

He noted that the Japanese market is facing substantial pressure due to the prevailing uncertainty surrounding the impending Bank of Japan meeting.

Additionally, risk appetite remained subdued following Israel's extensive attack in Gaza over the weekend.

“We suggest that investors remain cautious due to the escalating global volatility and uncertainties.

“While the valuation of the benchmark index is undemanding, we expect bargain hunting to emerge soon,” he said.

Thong said the research firm is also anticipating the KLCI to remain in consolidation mode for the time being and trend within the range of 1,430-1,450 for the week, with immediate resistance at 1,445 and support at 1,430.

Among the heavyweights, PPB Group Bhd declined 32 sen to RM15.12, Axiata Group Bhd shed five sen to RM2.26, Nestle Bhd fell RM1.40 to RM124.50, Petronas Gas Bhd lost 14 sen to RM17.02 and Maybank Bhd slid a sen to RM8.99.

Of the actives, both Classita Holdings Bhd and Kanger International Bhd were flat at 6.5 sen and 13.5 sen, respectively, while Sarawak Consolidated Industries Bhd added 1.5 sen to 55.5 sen, and Widad Group Bhd and MQ Technology Bhd rose half a sen each to 45 sen and three sen, respectively.

On the index board, the FBM Emas Index shaved 34.68 points to 10,599.32, the FBMT 100 Index was 31.22 points lower at 10,275.78 and the FBM Emas Shariah Index slipped 44.18 points to 10,801.94.

The FBM ACE Index dropped 32.67 points to 5,005.6 and the FBM 70 Index gave up 94.72 points to 13,902.98.

Sector-wise, the Consumer Products and Services Index was 2.37 points weaker at 551.13, the Industrial Products and Services Index fell 0.61 of a point to 172.12, the Energy Index decreased 10.94 points to 863.64 and the Financial Services Index went down 21.17 points to 16,212.2.

Meanwhile, the Plantation Index went up 9.83 points to 6,898.68.

The Main Market volume was higher at 1.72 billion units worth RM1.28 billion compared with 1.68 billion units valued at RM1.46 billion on Friday.

Warrant turnover narrowed to 352.09 million units valued at RM50.06 million against 406.73 million units worth RM66.54 million previously.

The ACE Market volume expanded to 726.30 million shares worth RM185.26 million from 620.01 million shares valued at RM164.01 million on Friday.

Consumer products and services counters accounted for 458.95 million shares traded on the Main Market, industrial products and services (371.39 million); construction (142.11 million); technology (174.48 million); SPAC (nil); financial services (41.13 million); property (200.34 million); plantation (19.7 million); REITs (11.26 million), closed/fund (16,600); energy (119.08 million); healthcare (74.27 million); telecommunications and media (23.77 million); transportation and logistics (49.18 million); and utilities (35.5 million).

Source: The Edge

Comments

Post a Comment