KUALA LUMPUR (Oct 12): Bursa Malaysia finished higher on Thursday, tracking the strong regional market performance, with buying interest mainly in banking and telecommunication stocks, ahead of the tabling of Budget 2024 on Friday.

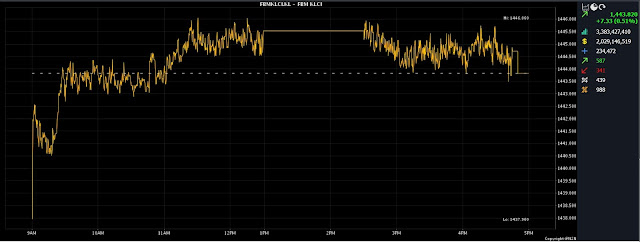

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) increased 7.33 points to 1,443.82 from Wednesday’s close of 1,436.49.

The index, which opened 1.47 points better at 1,437.96, moved between 1,437.96 and 1,446.06 throughout the day.

On the broader market, gainers outpaced decliners 587 to 341, while 439 counters were unchanged, 988 untraded and 11 others suspended.

Turnover increased to 3.38 billion units worth RM2.03 billion from 3.01 billion units worth RM2.18 billion on Wednesday.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said the key regional markets were also in the green following positive cues from global equities overnight, buoyed by easing global yield and renewed hopes of China's stimulus to boost growth in the world's second-largest economy.

"As for the local bourse, we continue to maintain our cautiously optimistic view due to the enhanced global market sentiment and decreased market volatility.

"Nonetheless, we recommend investors to remain vigilant ahead of the Budget 2024 announcement tomorrow (Oct 13)," he said.

Thong anticipates the benchmark index to trend within the range of 1,440-1,450 towards the weekend, with immediate resistance at 1,460 and support at 1,430.

Among the heavyweights, Maybank Bhd added nine sen to RM8.99, Public Bank Bhd went up three sen to RM4.18, CIMB Group Holdings Bhd put on six sen to RM5.66, Petronas Chemicals Group Bhd perked up four sen to RM7.27, and Tenaga Nasional Bhd inched up one sen to RM10.

Of the actives, SSF Home Group Bhd and NETX Holdings Bhd climbed 1.5 sen each to 26.5 sen and 18.5 sen, respectively, MMAG Holdings Bhd and BSL Corp Bhd improved half a sen each to 1.5 sen and four sen, respectively, while Classita Holdings Bhd eased half a sen to seven sen and Malaysian Resources Corp Bhd rose three sen to 49 sen.

On the index board, the FBM Emas Index increased by 57.46 points to 10,696.31, the FBMT 100 Index widened by 54.04 points to 10,357.53, the FBM Emas Shariah Index was up 42.43 points to 10,920.77, the FBM 70 Index jumped 80.46 points to 14,226.88, and the FBM ACE Index gained 1.06 points to 5,177.77.

Sector-wise, the Industrial Products Services Index edged up 1.83 points to 174.04, the Financial Services Index expanded 97.97 points to 16,278.52, while the Plantation Index lost 26.87 points to 6,846.77 and the Energy Index slid 3.06 points to 875.45.

The Main Market volume slipped to 2.04 billion units worth RM1.73 billion from 2.06 billion units worth RM1.92 billion on Wednesday.

Warrants turnover swelled to 349.42 million units valued at RM46.04 million against 246.68 million units valued at RM37.06 million on Wednesday.

The ACE Market volume surged to 996.1 million shares worth RM247.98 million from 684.53 million shares worth RM221.24 million previously.

Consumer products and services counters accounted for 453.17 million shares traded on the Main Market, industrial products and services (480.56 million); construction (169.62 million); technology (131.07 million); SPAC (nil); financial services (79.18 million); property (314.13 million); plantation (29.36 million); REITs (6.74 million), closed/fund (152,300); energy (209.27 million); healthcare (29 million); telecommunications and media (28.13 million); transportation and logistics (37.35 million); and utilities (69.81 million).

Source: The Edge

Comments

Post a Comment