KUALA LUMPUR (Oct 11): Bursa Malaysia just managed to close out the session in positive territory on Wednesday on the back of banking and gaming stocks amid advances by regional peers and ahead of Budget 2024 on Friday.

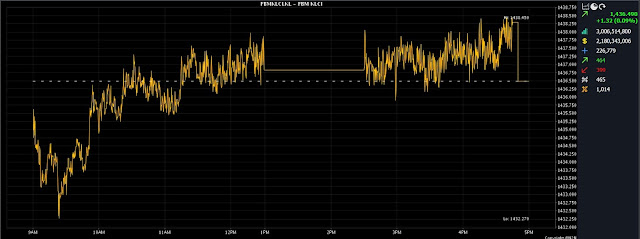

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) edged up 1.32 points to 1,436.49 from Tuesday’s closing of 1,435.17. The index, which opened 0.42 points weaker at 1,434.75, moved between 1,432.27 and 1,438.45 during the day.

On the broader market, gainers outpaced decliners 464 to 399, while 465 counters were unchanged, 1,014 untraded and 10 others suspended. Turnover decreased to 3.01 billion units worth RM2.18 billion from 3.39 billion units worth RM2.02 billion on Tuesday.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng noted that key regional indices ended on a positive note, taking the cue from Wall Street's rise overnight as retreating US bond yields lifted sentiment.

"Investors are finding relief in signs that inflationary pressures in many economies may be subsiding, potentially allowing the US Federal Reserve (Fed) and other central banks to pause or even reverse their aggressive interest rate hikes aimed at controlling price increases," he told Bernama.

Back home, he said market investors are cautiously optimistic given the improved local market sentiment and the return of foreign funds. "As such, we anticipate the FBM KLCI to trend higher within the range of 1,430-1,445 for the remainder of the week, with immediate resistance at 1,460 and the forming of a new support level at 1,430," he added.

SPI Asset Management managing partner Stephen Innes said the local market traded higher on Wednesday as US yields continued to trade softer while regional markets were also buoyed by hopes of fiscal stimulus in China.

"However, gains were limited ahead of US inflation data (Thursday) and the release of the Federal Open Market Committee (FOMC) minutes (later).

"Of course, the unknowns around what's next for the Middle East are not helping matters either. But so far this week, lower US yields have had a more substantial impact on broader markets than any Middle East risk-off sentiment at this stage," he said.

Among the heavyweights, Maybank increased one sen to RM8.90, Public Bank rose two sen to RM4.15 and Tenaga Nasional also rose two sen to RM9.99. CIMB gained five sen to RM5.60 but Petronas Chemicals lost seven sen to RM7.23.

Of the actives, Sarawak Consolidated perked up two sen to 51.5 sen, Classita edged down half-a-sen to 7.5 sen and KNM Group shed one sen to 11 sen. Kanger International eased 1.5 sen to 10 sen while UEM Sunrise similarly eased 1.5 sen to 85.5 sen.

On the index board, the FBM Emas Index improved by 9.57 points to 10,638.85, the FBMT 100 Index widened by 8.95 points to 10,303.49 and the FBM Emas Shariah Index slid by 8.98 points to 10,878.34.

The FBM 70 Index went up 9.88 points to 14,146.42 and the FBM ACE Index slipped 16.80 points to 5,176.71.

Sector-wise, the Plantation Index weakened 25.14 points to 6,873.64, the Financial Services Index jumped 70.87 points to 16,180.55 and the Energy Index edged up 3.65 points to 878.51. The Industrial Products Services Index was weaker by 0.62 points to 172.21.

Main Market volume slipped to 2.06 billion units worth RM1.92 billion from 2.34 billion units worth RM1.77 billion on Tuesday.

Warrant turnover reduced to 246.68 million units valued at RM37.06 million against 363.63 million units valued at RM52.36 million on Tuesday.

ACE Market volume strengthened to 684.53 million shares worth RM221.24 million from 674.16 million shares worth RM197.00 million previously.

Consumer products and services counters accounted for 413.75 million shares traded on the Main Market, industrial products and services (436.08 million); construction (144.59 million); technology (84.40 million); SPAC (nil); financial services (83.71 million); property (308.69 million); plantation (39.17 million); REITs (8.03 million), closed/fund (66,400); energy (361.01 million); healthcare (59.07 million); telecommunications and media (27.23 million); transportation and logistics (32.62 million) and utilities (58.49 million).

Comments

Post a Comment