KUALA LUMPUR (Oct 24): Bursa Malaysia ended mixed on Tuesday as profit taking earlier in the day tapered off as bargain hunting sets in while the market awaits fresh catalysts, dealers said.

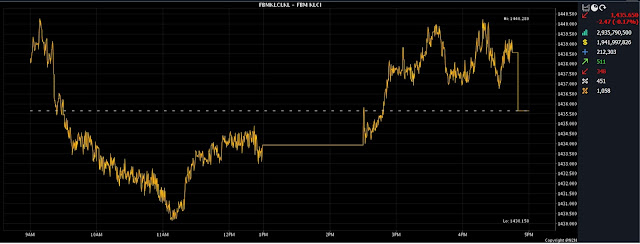

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) erased 2.47 points to 1,435.65 from Monday’s closing of 1,438.12.

The index opened 0.16 of a point better at 1,438.28 and moved between 1,430.15 and 1,440.28 throughout the day.

However, on the broader market, gainers surpassed decliners 510 to 348, while 452 counters were unchanged, 1,058 untraded and 13 suspended.

Turnover decreased to 2.93 billion units worth RM1.94 billion from 3.38 billion units worth RM2 billion on Monday.

Apex Securities Bhd head of research Kenneth Leong said investors will be keeping a close watch on the ongoing quarterly corporate earnings releases in the US such as Coca-Cola, Microsoft, Alphabet, and Visa later on Tuesday night.

"Looking ahead, we expect the local bourse to find stability amid signs of easing selling activities as the key index rebounded from its intraday low today," he said.

Meanwhile, Rakuten Trade Sdn Bhd equity research vice president Thong Pak Leng believed that investor sentiment will remain cautious in the near term, considering the growing external risks and volatility, coupled with selling pressure from foreign funds.

"As such, we expect the FBM KLCI to trend sideways within the 1,430 to 1,450 range for the rest of the week, with immediate support at 1,430 and support at 1,460,” he said.

Bursa heavyweights Maybank Bhd lost three sen to RM8.96, Public Bank Bhd fell two sen to RM4.14, CIMB Group Holdings Bhd gained two sen to RM5.68, Petronas Chemicals Group Bhd rose eight sen to RM7.15, and Tenaga Nasional Bhd was unchanged at RM9.85.

Of the actives, Widad Group Bhd dipped 10.5 sen to 43 sen, Metronic Global Bhd eased half a sen to 1.5 sen, Sarawak Consolidated Industries Bhd expanded 1.5 sen to 54 sen, Kanger International Bhd increased one sen to 12.5 sen, and KNM Group Bhd put on two sen to 11 sen.

On the index board, the FBM Emas Index was 13.52 points higher at 10,591.33, the FBMT 100 Index advanced 6.39 points to 10,267.85 and the FBM Emas Shariah Index expanded 21.09 points to 10,818.26.

The FBM 70 Index jumped 113.62 points to 13,968.43 and the FBM ACE Index climbed 22.61 points to 5,047.31.

Sector-wise, the Industrial Products and Services Index was 0.86 of a point better at 171.11 and the Energy Index perked up 5.91 points to 873.85.

However, the Financial Services Index went down 22.71 points to 16,181.11 and the Plantation Index gave up 16.37 points to 6,857.24.

The Main Market volume was lower at 1.83 billion units worth RM1.66 billion compared with 2.33 billion units worth RM1.72 billion on Monday.

Warrants turnover swelled to 322.59 million units valued at RM39.82 million against 195.82 million units valued at RM13.72 million on Monday.

The ACE Market volume decreased to 766.74 million shares worth RM235.04 million from 830.05 million shares worth RM259.45 million previously.

Consumer products and services counters accounted for 214.06 million shares traded on the Main Market, industrial products and services (524.73 million); construction (169.58 million); technology (243.96 million); SPAC (nil); financial services (61.49 million); property (240.68 million); plantation (24.02 million); REITs (11.57 million), closed/fund (28,100); energy (137.57 million); healthcare (57.35 million); telecommunications and media (31.76 million); transportation and logistics (43.7 million); and utilities (72.36 million).

Source: The Edge

Comments

Post a Comment