KUALA LUMPUR (June 9): Bursa Malaysia snapped a two-day losing streak to close slightly higher on Friday (June 9), in tandem with the uptrend in regional bourses, said an analyst.

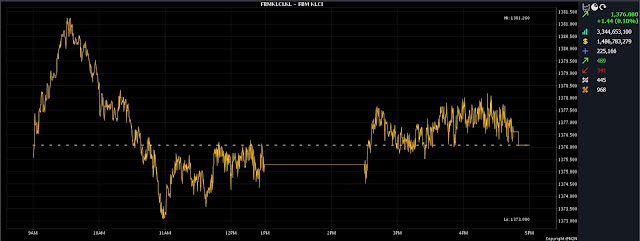

At 5pm, the FBM KLCI was marginally higher by 1.44 points, or 0.10%, at 1,376.08, from 1,374.64 at Thursday’s close.

The key index opened 0.94 of a point higher at 1,375.58 on Friday morning, and moved between 1,373.08 and 1,381.26 throughout the day.

Turnover widened to 3.34 billion units worth RM1.49 billion, versus 2.68 billion units worth RM1.61 billion on Thursday.

Malacca Securities Sdn Bhd senior analyst Kenneth Leong said the KLCI rebounded from earlier losses in the mid-morning on mild bargain-hunting activities for oversold stocks.

"Nevertheless, gains in the local bourse were kept to a minimal, owing to the extended weakness in selected Petroliam Nasional Bhd (Petronas)-related and banking heavyweights," he told Bernama.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said key regional indices ended mostly higher on optimism about potential economic stimulus in China.

Additionally, he said investors are leaning towards bets that the US Federal Reserve is likely to abstain from raising interest rates next week, lifting the regional sentiment.

Among the heavyweight stocks, Malayan Banking Bhd (Maybank) added two sen to RM8.62, Public Bank Bhd gained one sen to RM3.82, and Tenaga Nasional Bhd gained six sen to RM9.18. CIMB Group Holdings Bhd earned five sen to RM4.95, while Petronas Chemicals Group Bhd dropped two sen to RM6.40.

Of the actives, XOX Bhd at 1.5 sen, Borneo Oil Bhd at 1.5 sen, Sapura Energy Bhd at 3.5 sen, and Parlo Bhd at 12.5 sen were all flat. Sarawak Consolidated Industries Bhd added two sen to 30 sen.

On the index board, the FBM Emas Index inched up 27.70 points to 10,151.98, the FBMT 100 Index was 23.42 points firmer at 9,849.87, and the FBM Emas Shariah Index gained 31.83 points to 10,482.06.

The FBM ACE Index climbed 79.69 points to 5,050.83, and FBM 70 Index was 86.06 points stronger to 13,435.83.

Sector-wise, the Industrial Products and Services Index edged up 0.23 of a point to 157.91, the Plantation Index gained 41.64 points to 6,686.64, and the Energy Index advanced 12.49 points to 791.30.

The Financial Services Index ticked up 20.43 points to 15,139.96.

The Main Market volume advanced to 2.06 billion units valued at RM1.26 billion, from 1.74 billion units valued at RM1.37 billion on Thursday.

Warrant turnover recovered to 351.56 million units worth RM49.99 million, against 294.33 million units worth RM43.74 million previously.

The ACE Market volume ballooned to 933.33 million shares valued at RM176.55 million, from 646.14 million shares valued at RM202.85 million on Thursday.

Consumer products and services counters accounted for 390.03 million shares traded on the Main Market, followed by industrial products and services (726.77 million), construction (68.76 million), technology (137.69 million), special purpose acquisition companies (nil), financial services (43.88 million), property (188.03 million), plantation (51.96 million), real estate investment trusts (4.45 million), closed/funds (4,000), energy (274.99 million), healthcare (48.50 million), telecommunications and media (36.09 million), transportation and logistics (36.57 million), and utilities (51.22 million).

Comments

Post a Comment