KUALA LUMPUR (June 1): Bursa Malaysia continued to be sluggish on Thursday (June 1) amid a lack of impetus despite the optimism surrounding the US debt ceiling development.

The bill to raise the US debt ceiling was passed in the House of Representatives and will now go to the Senate for a final vote ahead of Monday’s deadline.

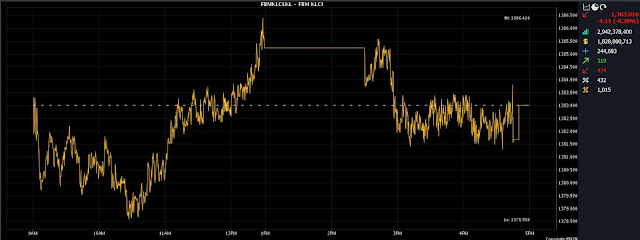

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) fell by 4.11 points to 1,383.01 from 1,387.12 at Wednesday’s close.

The key index opened 3.82 points weaker at 1,383.30 on Thursday morning and moved between 1,378.58 and 1,386.41 throughout the session.

The broader market was negative with decliners surpassing advancers 474 to 319, while 432 counters were unchanged, 1,015 untraded and 27 others suspended.

Turnover declined to 2.94 billion units worth RM1.81 billion versus 3.54 billion units worth RM5.25 billion on Wednesday.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng believes Congress will approve the increase in the US debt ceiling later on Thursday in order to save the country’s economy.

Nevertheless, he said the market may test a rebound on Friday and investors may nibble on beaten-down counters.

Earlier, the local market attempted a mild recovery but follow-through support was limited, an analyst said.

Regionally, most equity markets managed to recover with mild gains and may lend support to the domestic market on Friday.

Back home, CelcomDigi Bhd, MISC Bhd and Malayan Banking Bhd (Maybank) were the top losers among heavyweights. CelcomDigi dropped nine sen to RM4.38, MISC declined 15 sen to RM7.15 and Maybank fell five sen to RM8.60.

In contrast, both Press Metal Aluminium Holdings Bhd and Maxis Bhd gained, with Press Metal rising nine sen to RM4.70 and Maxis increasing nine sen to RM4.20.

Among the actives, Borneo Oil Bhd was flat at two sen, MyEG Services Bhd was unchanged at 84 sen, YTL Corp Bhd shed seven sen to 90 sen and Synergy House Bhd dipped eight sen to 35 sen.

On the index board, the FBM Emas Index dwindled 39.86 points to 10,203.23, the FBMT 100 Index gave up 39.43 points to 9,910.08, the FBM Emas Shariah Index declined 53.16 points to 10,553.35, the FBM 70 Index slipped 95.06 points to 13,561.81, while FBM ACE Index improved 2.51 points to 4,949.75.

Sector-wise, the Financial Services Index slid 13.45 points to 15,193.29 and the Industrial Products and Services Index eased 0.33 of-a-point to 158.78, the Energy Index eased 2.76 points to 806.68, while the Plantation Index climbed by 5.71 points to 6,606.79.

The Main Market volume decreased to 2.15 billion units valued at RM1.61 billion from 2.75 billion units valued at RM5.03 billion on Wednesday.

Warrants turnover tumbled to 178.78 million units worth RM35.22 million against 253.92 million units worth RM35.22 million on Wednesday.

The ACE Market volume expanded to 611.59 million shares valued at RM189.98 million from 535.22 million shares valued at RM186.02 million previously.

Consumer products and services counters accounted for 304.97 million shares traded on the Main Market, industrial products and services (913.16 million), construction (62.31 million), technology (179.35 million), SPAC (nil), financial services (70.40 million), property (201.95 million), plantation (23.33 million), REITs (13.45 million), closed/fund (84,000), energy (122.65 million), healthcare (54.40 million), telecommunications and media (47 million), transportation and logistics (27.22 million), and utilities (130.19 million).

Source: The Edge

Comments

Post a Comment