KUALA LUMPUR (June 12): Bursa Malaysia maintained its upbeat momentum to close higher on Monday (June 12), driven by bargain-hunting on improved market sentiment, said an analyst.

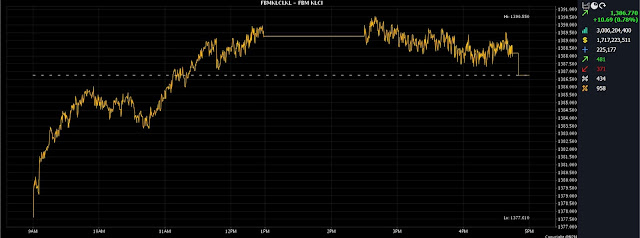

At 5pm, the FBM KLCI had improved 10.69 points, or 0.78%, to 1,386.77, from 1,376.08 at last Friday’s close.

The key index opened 1.53 points firmer at 1,377.61 on Monday morning, and moved between 1,377.61 and 1,390.55 throughout the day.

Market breadth was positive, as gainers beat decliners 481 to 371, while 434 counters were unchanged, 958 untraded, and 12 others suspended.

Turnover decreased marginally to 3.01 billion units worth RM1.72 billion, versus 3.34 billion units worth RM1.49 billion last Friday.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said the KLCI ended higher, as investors took the opportunity to bargain-hunt for stocks at lower levels, following the heavy selldown since late May.

“The key regional markets closed broadly higher as market sentiment was positive, ahead of this week's US Federal Open Market Committee meeting [on Tuesday and Wednesday],” he told Bernama.

Japan's Nikkei 225 added 0.52% to 32,434.00, Hong Kong’s Hang Seng Index put on 0.07% to 19,404.31, and China’s Shenzhen Index rose 0.74% to 10,873.74.

Thong said there is a possibility that the KLCI may visit the 1,400 level this week.

He said, in the meantime, multiple rate cuts from several lenders in China had raised the expectations of no rate hike from the People’s Bank of China.

“As for the local bourse, we are cautiously optimistic given the improving sentiment in the local market. Nonetheless, global volatility will also play a major role in the direction of the market.

“Barring unforeseen circumstances, we anticipate the KLCI to trend within the 1,385-1,400 range for the week.

“Technically, we see immediate resistance at 1,390, followed by 1,415, and support at 1,373, followed by 1,350,” he added.

Among the heavyweights, Malayan Banking Bhd (Maybank) added one sen to RM8.63, Public Bank Bhd rose three sen to RM3.85, Tenaga Nasional Bhd garnered eight sen to RM9.26, CIMB Group Holdings Bhd went up seven sen to RM6.65, and Petronas Chemicals Group Bhd advanced 25 sen to RM6.65.

Of the actives, XOX Bhd at two sen and Classita Holdings Bhd at 13 sen had gained half a sen each, Sarawak Consolidated Industries Bhd ticked up 2.5 sen to 32.5 sen, while Bumi Armada Bhd fell 5.5 sen to 42 sen, and Widad Group Bhd was flat at 42 sen.

On the index board, the FBM Emas Index rose 65.14 points to 10,217.12, the FBMT 100 Index was 64.67 points firmer at 9,914.54, and the FBM Emas Shariah Index gained 70.55 points to 10,552.61.

The FBM ACE Index climbed 25.80 points to 5,076.63, and the FBM 70 Index increased 39.24 points to 13,475.07.

Sector-wise, the Industrial Products and Services Index edged up 1.90 points to 159.81, the Plantation Index expanded 71.00 points to 6,757.64, and the Financial Services Index ticked up 79.46 points to 15,219.42, while the Energy Index declined 13.43 points to 777.87.

The Main Market volume slid to 1.97 billion units valued at RM1.50 billion, from 2.06 billion units valued at RM1.26 billion last Friday.

Warrant turnover decreased to 325.46 million units worth RM45.50 million, against 351.56 million units worth RM49.99 million previously.

The ACE Market volume tumbled to 709.24 million shares valued at RM171.07 million, from 933.33 million shares valued at RM176.55 million last Friday.

Consumer product and service counters accounted for 467.05 million shares traded on the Main Market, followed by industrial products and services (433.14 million), construction (86.50 million), technology (205.02 million), special purpose acquisition companies (nil), financial services (104.30 million), property (184.19 million), plantation (39.00 million), real estate investment trusts (6.02 million), closed/funds (56,000), energy (236.81 million), healthcare (64.86 million), telecommunications and media (37.49 million), transportation and logistics (22.17 million), and utilities (80.52 million).

Source: The Edge

Comments

Post a Comment