KUALA LUMPUR (June 13): Bursa Malaysia retreated from Monday's (June 12) gains to close lower on Tuesday, despite the upbeat regional market performance ahead of the release of US consumer price index (CPI) data later on Tuesday.

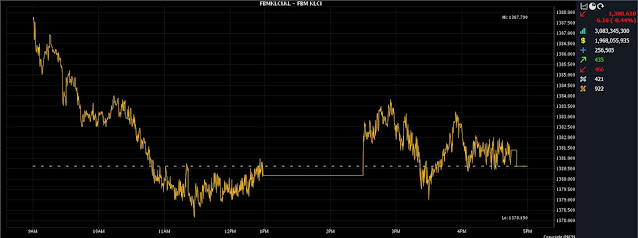

At 5pm, the FBM KLCI had eased 6.16 points, or 0.44%, to 1,380.61, from 1,386.77 at Monday’s close.

The key index opened 0.92 of a point firmer at 1,387.69 on Tuesday morning, and moved between 1,378.15 and 1,387.79 throughout the day.

Market breadth was negative, as decliners led gainers 466 to 434, while 421 counters were unchanged, 923 untraded, and 12 others suspended.

Turnover increased marginally to 3.08 billion units worth RM1.97 billion, versus 3.01 billion units worth RM1.72 billion on Monday.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said the KLCI was lower on Tuesday, as investors took profit after Monday's firm rally.

He said the key regional indices were higher, following a positive cue from global equities overnight, with strong gains for tech stocks.

Japan's Nikkei 225 added 1.80% to 33,018.65, Hong Kong’s Hang Seng Index put on 0.60% to 19,521.42, and China’s Shenzhen Index rose 0.76% to 10,955,96, while Singapore’s Straits Times Index slipped 0.16% to 3,190.82.

"Investors were eagerly anticipating a temporary break in the US Federal Reserve's (Fed) highly aggressive tightening campaign, leading the stock market to maintain its bullish momentum.

"Additionally, China’s central bank cut a short-term policy interest rate, easing its monetary stance to help aid the world's second-largest economy in its recovery," he told Bernama.

Thong said despite the profit-taking on Tuesday, investors remained cautiously optimistic, amid the improving global market sentiment.

He anticipates the KLCI to move within the range of 1,375-1,390 for the remainder of the week, with immediate resistance at 1,390, followed by 1,415, and support at 1,373.

Meanwhile, SPI Asset Management managing director Stephen Innes said even though US stocks were trading higher on expectations of a US Fed interest rate pause and softer inflation, Asian markets were not keeping pace with this run.

In addition, he said China's economy was still struggling, which put a damper on regional risk, hence he expects investors to be reticent to push higher this week, ahead of China's activity data to be released on Friday.

"Still, the bigger and more immediate question comes from today's (Tuesday) US CPI data, and how that outcome affects the Fed’s reaction.

"In other words, local investors are still worried that US inflation could come in hot, and could cause the Fed to hike [interest rates] on Wednesday," he added.

Among the heavyweights, Malayan Banking Bhd (Maybank) shed one sen to RM8.62, Public Bank Bhd fell four sen to RM3.81, CIMB Group Holdings Bhd decreased three sen to RM4.99, Tenaga Nasional Bhd slid 12 sen to RM9.14, and Petronas Chemicals Group Bhd went down 23 sen to RM6.42.

Of the actives, Sarawak Consolidated Industries Bhd added 4.5 sen to 37 sen, Bumi Armada Bhd increased three sen to 45 sen, XOX Bhd eased half a sen to 1.5 sen, Kumpulan Jetson Bhd lost 9.5 sen to 33 sen, while Widad Group Bhd was flat at 42 sen.

On the index board, the FBM Emas Index shrank 20.12 points to 10,197.00, the FBMT 100 Index was 21.77 points weaker at 9,892.77, and the FBM Emas Shariah Index trimmed 15.00 points to 10,537.61.

The FBM ACE Index climbed 69.90 points to 5,146.53, and the FBM 70 Index increased 62.60 points to 13,537.67.

Sector-wise, the Industrial Products and Services Index edged down 1.06 points to 158.75, the Plantation Index slipped 39.40 points to 6,718.24, the Financial Services Index declined 20.03 points to 15,199.39, and the Energy Index put on 2.79 points to 780.66.

The Main Market volume slid to 1.95 billion units valued at RM1.68 billion, from 1.97 billion units valued at RM1.50 billion on Monday.

Warrant turnover expanded to 377.22 million units worth RM56.52 million, against 325.46 million units worth RM45.50 million previously.

The ACE Market volume increased to 750.12 million shares valued at RM227.64 million, from 709.24 million shares valued at RM171.07 million on Monday.

Consumer products and services counters accounted for 359.62 million shares traded on the Main Market, followed by industrial products and services (644.03 million), construction (47.12 million), technology (245.46 million), special purpose acquisition companies (nil), financial services (72.50 million), property (138.58 million), plantation (32.21 million), real estate investment trusts (8.29 million), closed/funds (64,000), energy (180.49 million), healthcare (78.29 million), telecommunications and media (43.40 million), transportation and logistics (48.62 million), and utilities (51.38 million).

Meanwhile, in a filing on Tuesday, Bursa Malaysia Securities announced that trading of the securities relating to Boustead Holdings Bhd will be suspended with effect from 9am next Tuesday (June 20), pursuant to Paragraph 16.02(3) of the Main Market Listing Requirements.

Source: The Edge

Comments

Post a Comment