KUALA LUMPUR (June 28): Bursa Malaysia pared earlier gains but still ended marginally higher on Wednesday (June 28), in tandem with the improving sentiment in regional peers after a rally on Wall St overnight on a solid set of US economic data.

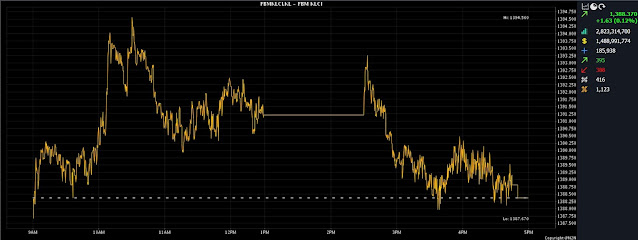

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) edged up 1.63 points, or 0.12% to 1,388.37 from 1,386.74 at Tuesday’s June 27) close.

The key index opened 0.93 of a point firmer at 1,387.67 in the morning — the lowest for the day — before rising as high as 1,394.56 during mid-session.

The broader market was also positive as gainers outpaced decliners 395 to 388, while 416 counters were unchanged, 1,123 untraded and 84 others suspended.

Turnover expanded to 2.82 billion units worth RM1.49 billion versus 2.59 billion units worth RM1.51 billion on Tuesday.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said key regional indices ended broadly higher following positive cues from global equities.

Regionally, Japan's Nikkei jumped 2.02% to 33,193.99 and Hong Kong’s Hang Seng Index added 0.12% to 19,172.05.

“Investors are positive, yet vigilant, on the outlook for the global economy,” he said.

He said investors were cautiously optimistic given the improvement in the local and regional market sentiment. “We anticipate the FBM KLCI to trend within the range of 1,385-1,400 for the rest of the week. From a technical point of view, we spot the resistance at 1,400 and support at 1,373,” he added.

Of the heavyweight stocks, Maybank Bhd and Public Bank Bhd gained two sen each to RM8.73 and RM3.87, respectively. IHH Healthcare Bhd went up five sen to RM5.87, Tenaga Nasional Bhd slid 18 sen to RM9.01 while CIMB Bhd was flat at RM5.15.

Of the actives, Sarawak Consolidated Industries Bhd and Classita Holdings Bhd edged up half a sen each to 45 sen and 9.5 sen respectively while MyEG shed 4.5 sen to 75.5 sen. Borneo Oil Bhd and Fitters Diversified Bhd were flat at 1.5 sen and four sen, respectively.

On the index board, the FBM Emas Index was 8.78 points firmer at 10,203.09, the FBMT 100 Index earned 8.92 points to 9,906.98 and the FBM Emas Shariah Index shrank 10.4 points to 10,473.27.

The FBM 70 Index perked up by 0.54 of a point to 13,382.96, and the FBM ACE Index recovered 34.14 points to 5,079.17.

Sector-wise, the Financial Services Index garnered 41.15 points to 15,427.47 and the Industrial Products and Services Index lost 0.40 of-a-point to 157.87.

The Energy Index edged down by 0.38 of a point to 780.94 and the Plantation Index erased 22.57 points to 6,725.85.

The Main Market volume expanded to 2.12 billion units valued at RM1.25 billion from 1.8 billion units valued at RM1.26 billion on Tuesday.

Warrant turnover dwindled to 203.86 million units worth RM37.26 million against 218.45 million units worth RM38.82 million previously.

The ACE Market volume dropped to 496.25 million shares valued at RM204.3 million from 534.07 million shares valued at RM215.58 million on Tuesday.

Consumer products and services counters accounted for 341.54 million shares traded on the Main Market, industrial products and services (915.26 million); construction (61.85 million); technology (233.25 million); SPAC (nil); financial services (47.15 million); property (202.19 million); plantation (24.9 million); REITs (4.57 million), closed/fund (85,400); energy (111.47 million); healthcare (45 million); telecommunications and media (22.7 million); transportation and logistics (11.07 million); and utilities (100.82 million).

Meanwhile, Bursa Malaysia Bhd announced the change in the name of SYF Resources Bhd to M&A Equity Holdings Bhd (M&A).

In a statement on Wednesday, it said the local bourse also decided to update the classification of the sector for M&A to financial services from consumer products and services while the sub-sector was changed to “other financials” from household goods.

The company’s securities will be traded and quoted under the new name, new sector and new sub-sector effective from 9am, June 30, 2023. The stock number remains unchanged.

Source: The Edge

Comments

Post a Comment