KUALA LUMPUR (May 22): Bursa Malaysia snapped four consecutive days of gains to end lower on Monday (May 22) on continued selling in financial services and telecommunication counters despite the upbeat sentiment on regional bourses, said an analyst.

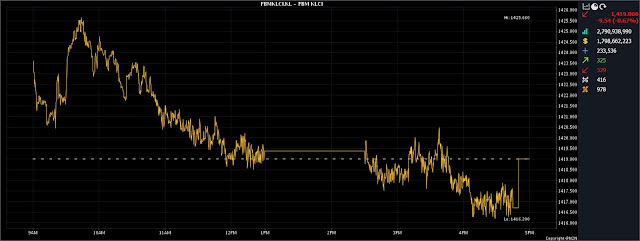

At 5.00pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) was down 9.54 points to close at 1,419.00 compared with 1,428.54 at last Friday's close.

The barometer index opened 4.92 points weaker at 1,423.62 this morning and moved between 1,416.20 and 1,425.66 throughout the day.

Turnover decreased to 2.79 billion units worth RM1.79 billion from 2.85 billion units worth RM1.81 billion on Friday.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said the local stock market closed lower on Monday due to selling in heavyweights such as Maybank, Tenaga Nasional and Maxis.

Region-wise, he said the key regional indices ended higher despite worries about the US debt ceiling talks.

"Investors are closely observing a significant meeting scheduled to take place later today at the White House as the US President Joe Biden and House Speaker Kevin McCarthy will be discussing the crucial topic of debt ceiling during this meeting.

"As for the local bourse, we believe today's sell-down will provide opportunities for investors to accumulate blue-chip stocks at lower levels, which hold potential for future upsides," he told Bernama.

On the other hand, Rakuten Trade expects the short-term market sentiment to remain cautious, at least until the US debt ceiling is finalised.

"Therefore, we anticipate the market to move sideways with an upside bias within the range of 1,415-1,430 points for the week.

"On a technical point of view, we see the immediate support at 1,415 and resistance at 1,440," Thong said.

Among heavyweights, Maybank gave up 20.0 sen to RM8.58, Public Bank eased 3.0 sen to RM3.95, Tenaga Nasional went down 22.0 sen to RM9.60, while Petronas Chemicals rose 10.0 sen to RM6.96, CIMB increased 3.0 sen to RM5.05, and IHH Healthcare edged up 1.0 sen to RM5.96.

As for the active counters, Bahvest Resources climbed 1.5 sen to 15.5 sen, Jade Marvel added 2.5 sen to 24.5 sen, DXN Holdings lost 3.0 sen to 63.5 sen, Vinvest Capital Holdings advanced 1.0 sen to 8.0 sen, while Ta Win-warrant 2021/2024 was flat at half-a-sen.

On the index board, the FBM Emas Index dipped 58.88 points to 10,415.87, the FBMT 100 Index slid 55.90 points to 10,114.46, the FBM Emas Shariah Index declined 40.35 points to 10,789.16, the FBM 70 Index went down 25.06 points to 13,620.69, and the FBM ACE Index shrank 47.37 points to 4,955.53.

Sector-wise, the Industrial Products and Services Index improved 0.09 of-a-point to 165.08, the Plantation Index gained 1.74 points to 7,028.29, and the Energy Index added 2.40 points to 841.93.

The Financial Services Index, however, decreased 117.60 points to 15,488.63.

The Main Market volume declined to 1.55 billion units valued at RM1.56 billion from 1.83 billion units valued at RM1.60 billion on Friday.

Warrants turnover increased to 387.19 million units worth RM59.55 million against 368.4 million units worth RM50.59 million previously.

The ACE Market volume expanded to 834.45 million shares valued at RM181.65 million versus 641.33 million shares valued at RM152.51 million last Friday.

Consumer products and services counters accounted for 382.36 million shares traded on the Main Market, industrial products and services (400.79 million); construction (54.28 million); technology (184.91 million); SPAC (nil); financial services (56.68 million); property (132.59 million); plantation (31.26 million); REITs (7.27 million), closed/fund (300); energy (84.25 million); healthcare (109.15 million); telecommunications and media (34.09 million); transportation and logistics (17.06 million); and utilities (58.57 million).

Source: The Edge

Comments

Post a Comment