KUALA LUMPUR (May 24): Bursa Malaysia ended slightly lower on Wednesday (May 24) despite late gains in selected industrial products and services as well as telecommunications and media counters.

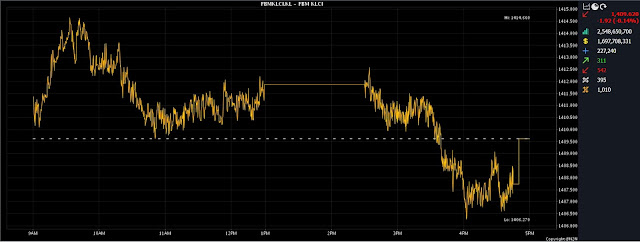

At 5.00pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) fell 1.92 points to close at 1,409.62 compared with 1,411.54 at Tuesday's close.

The key index opened 0.18 of a point weaker at 1,411.36 this morning and moved between 1,414.66 and 1,406.27 throughout the day.

The broader market was also negative with decliners outpacing advancers 542 to 311, while 395 counters were unchanged, 1,010 untraded and 14 others suspended.

Turnover increased to 2.55 billion units worth RM1.70 billion from 2.46 billion units worth RM1.66 billion on Tuesday.

Petronas Chemicals and Telekom Malaysia were the top two contributors to the local benchmark index, rising 6.0 sen and 10.0 sen to RM6.95 and RM5.09, respectively, for a combined 1.47 points.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said regionally, key indices closed lower following negative cue from Wall Street overnight as the US government crept closer to a potentially disruptive default on its debts.

“Meanwhile, fears of worsening Sino-US tensions also dampened sentiment towards the region.

“Additionally, China has recently banned the use of US-based Micron Technology's chips, causing some selldown in the US tech sector,” he told Bernama.

As for the local bourse, he said investor sentiment was expected to remain cautious for the short-term due to the heightened regional market volatility as a result of the abovementioned reasons.

“On the other hand, strong corporate earnings performance, especially among blue chip stocks, is expected to significantly enhance investor sentiment.

“Moreover, the benchmark index remains in an oversold position; hence we expect bargain hunting will emerge especially on banks and telco stocks,” Thong said, adding that the FBM KLCI was set to trend higher within the range of 1,410-1,425 for the remainder of the week."

Among the other heavyweights, Maybank and IHH Healthcare reduced 5.0 sen to RM8.56 and RM5.85 respectively, Tenaga Nasional eased 4.0 sen to RM9.52, and CIMB Group slid 3.0 sen to RM4.98; but Public Bank increased 1.0 sen to RM3.92.

As for the active counters, Bahvest Resources perked 3.0 sen to 19.0 sen, Tanco gained half-a-sen to 55.0 sen, BSL Corporation gave up 1.0 sen to 4.0 sen, Jade Marvel went down 1.5 sen to 22.0 sen, and Sapura Energy was flat at 3.5 sen.

On the index board, the FBM Emas Index dipped 30.17 points to 10,340.48, the FBMT 100 Index fell 26.80 points to 10,043.69, the FBM Emas Shariah Index declined 25.42 points to 10,716.79, the FBM 70 Index went down 90.55 points to 13,509.26, and the FBM ACE Index ticked up 30.01 points to 4,947.80.

Sector-wise, the Industrial Products and Services Index dropped 0.13 of a point to 164.00, the Plantation Index trimmed 38.48 points to 6,936.67, the Energy Index lost 6.71 points to 830.14, and the Financial Services Index decreased 60.88 points to 15,349.33.

The Main Market volume rose to 1.71 billion units valued at RM1.50 billion from 1.59 billion units valued at RM1.45 billion on Tuesday.

Warrants turnover declined to 293.91 million units worth RM41.75 million against 378.99 million units worth RM52.05 million on Tuesday.

The ACE Market volume grew to 540.12 million shares valued at RM156.51 million from 490.11 million shares valued at RM151.28 million previously.

Consumer products and services counters accounted for 267.73 million shares traded on the Main Market, industrial products and services (408.18 million); construction (63.43 million); technology (155.79 million); SPAC (nil); financial services (55.12 million); property (176.12 million); plantation (38.84 million); REITs (7.71 million), closed/fund (36,000); energy (315.39 million); healthcare (85.10 million); telecommunications and media (47.92 million); transportation and logistics (26.07 million); and utilities (59.44 million).

Source: The Edge

Comments

Post a Comment