KUALA LUMPUR (May 15): Bursa Malaysia closed lower for the fifth consecutive session on Monday (May 15), as weak market sentiment due to external developments weighed on investors’ risk appetite.

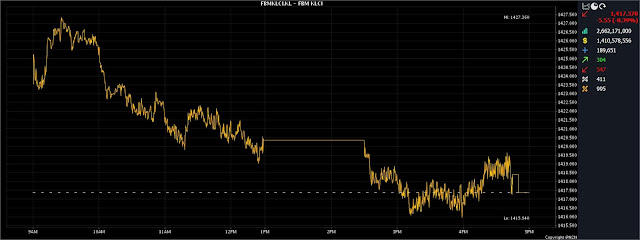

At 5pm, the FBM KLCI had fallen 5.55 points, or 0.39%, to 1,417.37, from last Friday’s close at 1,422.92.

The barometer index opened slightly higher at 1,423.53 on Monday morning, and then fluctuated between 1,415.94 and 1,427.36 throughout the day.

Market breadth was negative, with decliners beating gainers 547 to 304, while 411 counters were unchanged, 995 untraded, and 28 others suspended.

Turnover dropped marginally to 2.66 billion units worth RM1.41 billion, from 2.74 billion units valued at RM1.77 billion last Friday.

Malacca Securities Sdn Bhd senior analyst Kenneth Leong said the KLCI trended lower on Monday on worries over the US debt ceiling, and ahead of the release of China’s retail sales and industrial production data due on Tuesday.

“We expect the sentiment to remain tepid in the absence of fresh leads, while foreign funds are still trimming their holdings in Malaysian equities. Still, investors may keep a close watch on the current quarterly results reporting season,” he told Bernama.

Leong sees immediate support at 1,413 points, and resistance at 1,437 and 1,450.

Among the heavyweight counters, Public Bank Bhd eased three sen to RM3.94 a share, Petronas Chemicals Group Bhd shed five sen to RM6.98, CelcomDigi Bhd declined six sen to RM4.42, while Malayan Banking Bhd (Maybank) was flat at RM8.69.

Tenaga Nasional Bhd (TNB), however, rose six sen to RM9.52, and CIMB Group Holdings Bhd gained three sen to RM4.98.

As for the actives, Vsolar Group Bhd was flat at half a sen, Jade Marvel Group Bhd inched down half a sen to 26.5 sen, BSL Corp Bhd added half a sen to five sen, while Revenue Group Bhd slipped one sen to 31.5 sen.

On the index board, the FBM Emas Index shaved 39.02 points to 10,376.63, the FBMT 100 Index gave up 38.27 points for 10,073.11, and the FBM ACE Index shed 3.47 points to 4,981.01.

The FBM 70 index dropped 46.47 points to 13,441.69, and the FBM Emas Shariah Index lost 48.38 points to 10,727.54.

Sector-wise, the Industrial Products and Services Index trimmed 1.4 points to 165.72, the Energy Index eased 2.0 points to 827.39, the Financial Services Index declined 23.89 points to 15,489.39, and the Plantation Index fell 64.94 points to 6,891.72.

The Main Market volume went down to 1.62 billion units valued at RM1.17 billion, from 1.7 billion units valued at RM1.5 billion last Friday.

Warrant turnover improved to 394.36 million units worth RM69.14 million, against 338.39 million units worth RM54.18 million last Friday.

The ACE Market volume reduced to 649.65 million shares valued at RM175.52 million, versus 699.03 million shares valued at RM215.96 million previously.

Consumer products and services counters accounted for 250.99 million shares traded on the Main Market, followed by industrial products and services (550.72 million), construction (40.99 million), technology (190.77 million), special purpose acquisition companies (nil), financial services (43.69 million), property (200.63 million), plantation (27.36 million), real estate investment trusts (10.64 million), closed/funds (9,000), energy (139.46 million), healthcare (64.94 million), telecommunications and media (45.41 million), transportation and logistics (29.91 million), and utilities (21.37 million).

Source: The Edge

Comments

Post a Comment