KUALA LUMPUR (May 10): The FBM KLCI extended its decline for a second consecutive day on Wednesday (May 10), dragged down by selling mainly for banking stocks, in tandem with the weak regional performance.

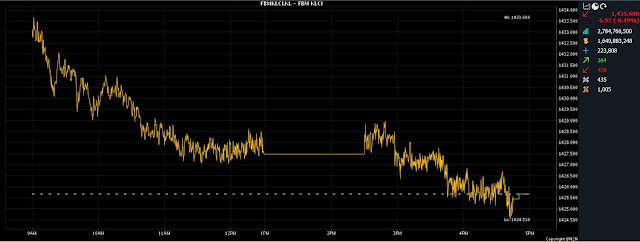

At 5pm, the market bellwether had eased by 6.95 points or 0.49% to 1,425.68, from Tuesday’s close at 1,432.63.

The key index opened 0.48 of a point firmer at 1,433.11, and moved between 1,424.53 and 1,433.68 throughout the day.

Market breadth was negative, with decliners surpassing gainers 438 to 364, while 435 counters were unchanged, 1,005 untraded, and 23 others suspended.

Turnover decreased to 2.78 billion units valued at RM1.65 billion, from 3.45 billion units valued at RM2.12 billion on Tuesday.

The financial services index dipped 0.74% or 117.62 points to 15,597.95.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said that regionally, the key indices ended mostly lower, following a negative cue from Wall Street overnight, as investors were cautiously awaiting the release of US inflation data later on Wednesday.

Meanwhile, news reports stated that White House officials and Republican leaders were engaged in contentious negotiations over the approval for a debt ceiling raise.

The White House was pushing for approval without compromising on spending initiatives, while the Republican House of Representatives Speaker reportedly said that he would not approve the debt ceiling raise, unless the US president's spending initiatives are cut to safeguard against the escalating budget deficit.

Back home, Thong believes that the reasonable valuations of the KLCI may attract bargain hunters, though the sentiment on the local market is expected to remain cautious.

Furthermore, the key index remained in an oversold position.

“Hence, we expect the KLCI to trend higher within the 1,435-1,440 range for the remainder of the week, with immediate resistance at 1,440, and support at 1,410,” he told Bernama.

Among the heavyweights, Malayan Banking Bhd (Maybank) slipped five sen to RM8.70 a share, Public Bank Bhd lost three sen to RM3.99, CIMB Group Holdings Bhd was nine sen lower at RM5.02, and Tenaga Nasional Bhd fell 17 sen to RM9.03.

Petronas Chemicals Group Bhd added 11 sen to RM7.31.

As for the actives, Bahvest Resources Bhd went down two sen to 11.5 sen, Jade Marvel Group Bhd decreased half a sen to 27 sen, while KNM Group Bhd was flat at six sen.

Top Glove Corp Bhd gained one sen to RM1.10, and Velesto Energy Bhd rose half a sen to 23.5 sen.

On the index board, the FBM Emas Index slid 34.24 points to 10,444.99, the FBMT 100 Index erased 35.04 points to 10,142.34, the FBM Emas Shariah Index declined 4.17 points to 10,797.19, and the FBM ACE Index slipped 12.88 points to 5,041.72, while the FBM 70 index went up 12.86 points to 13,576.32.

Sector-wise, the Industrial Products and Services Index edged down 0.10 of a point to 169.55, the Plantation Index rose 28.32 points to 6,838.52, and the Energy Index perked up 0.34 of a point to 833.31.

The Main Market volume dwindled to 1.87 billion units valued at RM1.44 billion, from 2.06 billion units valued at RM1.62 billion on Tuesday.

Warrant turnover shrank to 278.69 million units worth RM40.22 million, against 400.89 million units worth RM64.26 million previously.

The ACE Market volume tumbled to 638.24 million shares valued at RM166.15 million, versus 987.90 million shares valued at RM436.72 million a day earlier.

Consumer products and services counters accounted for 362.17 million shares traded on the Main Market, followed by industrial products and services (454.33 million), construction (78.87 million), technology (160.95 million), special purpose acquisition companies (nil), financial services (75.44 million), property (224.39 million), plantation (24.32 million), real estate investment trusts (7.22 million), closed/funds (12,000), energy (174.67 million), healthcare (214.14 million), telecommunications and media (44.52 million), transportation and logistics (20.52 million), and utilities (25.29 million).

Source: The Edge

Comments

Post a Comment