KUALA LUMPUR (April 4): Bursa Malaysia rebounded strongly to end higher on Thursday, making a swift recovery of its losses from the previous session, supported by mostly upbeat regional markets, said an analyst.

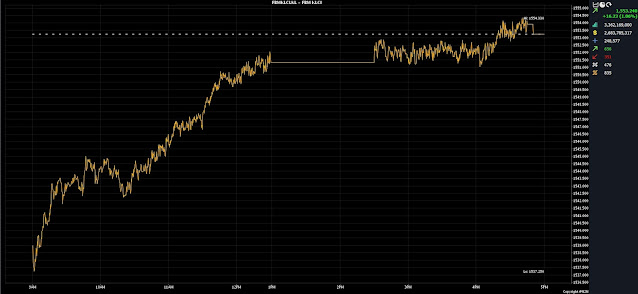

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) surged 16.23 points, or 1.05%, to 1,553.24 from Wednesday’s close of 1,537.01.

The benchmark index, which opened 1.97 points better at 1,538.98, moved between 1,537.25 and 1,554.33 throughout the trading session.

On the broader market, gainers thumped decliners 656 to 352, with 475 counters unchanged, 835 untraded and nine others suspended.

Turnover narrowed to 3.36 billion units valued at RM2.68 billion compared with 4.26 billion units worth RM2.87 billion on Wednesday.

Apex Securities Bhd head of research Kenneth Leong said the improved market sentiment was mainly driven by the dovish stance from the US Federal Reserve chairman Jerome Powell on Wednesday night, while the stronger crude palm oil (CPO) prices also lifted plantation giants higher on Wednesday.

“Moving forward, we expect the positive momentum to extend in view of the absence of negative developments.

“Still, investors will be focusing on the US jobs data on Friday to gauge the health of the world’s largest economy,” Leong said.

On the technical front, he said the KLCI has formed a bullish candle on Thursday to recover above the middle Bollinger Band.

Over the longer term, the key index is expected to remain rangebound within the consolidation band, oscillating between the immediate resistance located at 1,560 with the near-term support pegged at 1,520.

Among the heavyweights, Press Metal Aluminium Holdings Bhd climbed 35 sen to RM5.12, Sime Darby Plantation Bhd gained 15 sen to RM4.50, Sime Darby Bhd added five sen to RM2.74, Tenaga Nasional Bhd garnered 20 sen to RM11.50, Telekom Malaysia Bhd rose 10 sen to RM6.12, and YTL Corp Bhd edged up four sen to RM2.66.

As for the most active stocks, Fitters Diversified Bhd as flat at 5.5 sen, TDM Bhd improved four sen to 32.5 sen, Alpha IVF Group Bhd added 1.5 sen to 34.5 sen, while Widad Group Bhd and SNS Network Technology Bhd increased a sen each to eight sen and 38 sen respectively.

On the index board, the FBM Emas Index surged 96.71 points to 11,681.48, the FBMT 100 Index jumped 95.05 points to 11,316.87, and the FBM Emas Shariah Index soared 97.06 points to 11,810.89.

The FBM 70 Index rose 99.02 points to 16,328.45 and the FBM ACE Index climbed 18.12 points to 4,972.87.

Sector-wise, the Financial Services Index garnered 143.92 points to 17,295.77, the Energy Index put on 14.69 points to 980.73, the Plantation Index leapt 95.33 points to 7,406.49, and the Industrial Products and Services Index perked up 3.21 points to 183.12.

The Main Market volume increased to 2.21 billion units worth RM2.35 billion versus 1.99 billion units valued at RM2.48 billion on Wednesday.

Warrants turnover tumbled to 292.03 million units valued at RM28.75 million against 1.05 billion units worth RM126.96 million the previous day.

The ACE Market volume dwindled to 848.78 million shares worth RM295.91 million from 1.19 billion shares worth RM265.31 million previously.

Consumer products and services counters accounted for 314.8 million shares traded on the Main Market, industrial products and services (433.05 million); construction (168.95 million); technology (123.03 million); SPAC (0.00 million); financial services (83.26 million); property (504.75 million); plantation (123.98 million); REITs (19.34 million); closed/fund (4,000); energy (264.45 million); healthcare (36.75 million); telecommunications and media (39.87 million); transportation and logistics (44.19 million); and utilities (62.56 million).

Source: The Edge

Comments

Post a Comment