KUALA LUMPUR (April 1): Bursa Malaysia closed higher on Monday as investors chased selected major energy, plantation and telecommunication stocks.

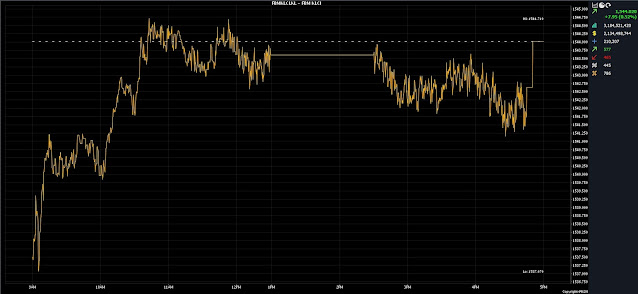

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) advanced 7.95 points, or 0.52 per cent to 1,544.02 from last Friday’s close of 1,536.07.

The benchmark index opened 1.43 points higher at 1,537.50 and moved between 1,537.07 and 1,544.71 throughout the day.

On the broader market, gainers led decliners 565 to 451 with 442 counters unchanged, 815 untraded, and eight others suspended.

Turnover expanded to 3.16 billion units worth RM2.13 billion from 3.06 billion units valued at RM2.59 billion on Friday.

Rakuten Trade Sdn Bhd equity research vice president Thong Pak Leng said the online equities brokerage is cautiously optimistic about the market given improving investor sentiment following positive economic data overseas. “

Nonetheless, investors are advised to stay alert on the increasing market volatility. We anticipate the FBM KLCI to trend within the range of 1,527-1,557 for the week with immediate support at 1,527 and resistance at 1,557,” he told Bernama.

Key regional indices also trended higher, buoyed by the positive outlook from China as the country's purchasing managers index (PMI) rebounded in March following a five-month decline while US inflation figures reaffirmed expectations for the US Federal Reserve to ease interest rate policy this year.

Of the heavyweights, Petronas Gas jumped 64 sen to RM18.26, PPB Group rallied 46 sen to RM15.84 and Maxis added 5.0 sen to RM3.42. Hong Leong Financial Group grew 24 sen to RM16.82 and CelcomDigi bagged 5.0 sen to RM4.24.

Among the actives, Bina Puri was flat at eight sen, Velesto at 29.5 sen and Sapura Energy at five sen. MYEG eased half-a-sen to 78.5 sen and Perdana Petroleum dropped one sen to 32 sen.

On the index board, the FBM Emas Index climbed 37.04 points to 11,608.63, the FBMT 100 Index added 32.38 points to 11,249.95 while the FBM Emas Shariah Index was 37.37 points stronger at 11,680.89.

The FBM ACE Index recovered 5.02 points to 4,902.08 while the FBM 70 Index declined 58.32 points to 16,175.76.

Sector-wise, the Industrial Products and Services Index inched up 0.42 of a point to 180.05, the Financial Services Index gained 62.02 points to 17,335.29 and the Plantation Index gained 28.75 points to 7,316.42. The Energy Index added 0.19 of a point to 952.55.

Meanwhile, the Main Market volume grew to 2.03 billion units valued at RM1.87 billion from 1.89 billion units worth RM2.33 billion on Friday.

Warrant turnover soared to 325.93 million units worth RM31.04 million from 282.04 million units valued at RM30.29 million previously.

The ACE Market volume, however, dropped to 802.35 million shares worth RM229.63 million from 855.36 million shares worth RM223.79 million on Friday.

Consumer products and services counters accounted for 251.04 million shares traded on the Main Market, industrial products and services (431.17 million); construction (221.47 million); technology (143.37 million); SPAC (0.00 million); financial services (69.03 million); property (489.11 million); plantation (34.86 million); REITs (14.94 million); closed/fund (53,600); energy (203.56 million); healthcare (47.42 million); telecommunications and media (26.42 million); transportation and logistics (57.16 million); and utilities (37.47 million).

Source: The Edge

Comments

Post a Comment