KUALA LUMPUR (Jan 30 ): Bursa Malaysia snapped its six-day winning streak to close lower on Tuesday as investors took profit from recent gains amid caution in regional markets as worries over China’s property sector weighed on sentiment, dealers said.

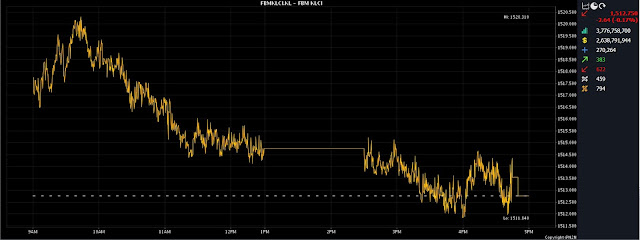

The FTSE Bursa Malaysia KLCI (FBM KLCI) slipped 2.64 points to end at 1,512.75 from Monday’s close of 1,515.39.

The barometer index, which opened 2.36 points better at 1,517.75, moved between 1,511.84 and 1,520.31 throughout the day.

Decliners led advancers 622 to 383 on the broader market, while 459 counters were unchanged, 794 untraded and 73 others suspended.

Turnover dropped to 3.78 billion units valued at RM2.6 billion from 4.32 billion units worth RM2.98 billion on Monday.

Bank Muamalat Malaysia Bhd chief economist Mohd Afzanizam Abdul Rashid said the local bourse and other regional markets were generally lower on Tuesday on growing concerns over China’s main property developer Evergrande Group. “A Hong Kong court has decreed a liquidation order [on Evergrande],” he noted.

“Perhaps, the news gave investors [a signal] to lock in some gains as the [local] benchmark index was up 9.11 points yesterday [on Monday],” he said.

Japan’s Nikkei 225 rose 0.11% to 36,065.86, Hong Kong’s Hang Seng Index tumbled 2.32% to 15,703.45 while Singapore's Straits Times Index gained 0.25% to 3,148.06. China’s SSE Composite Index slid 1.83% to 2,830.53.

Among the heavyweight counters, Maybank Bhd perked up a sen to RM9.24, Public Bank Bhd dropped a sen to RM4.40 and Tenaga Nasional Bhd lost two sen to RM10.48. IHH Healthcare Bhd fell nine sen to RM6.06 while CIMB Group Holdings Bhd was flat at RM6.22.

Of the actives, HE Group Bhd added 4.5 sen to 32.5 sen, Widad Group Bhd declined a sen to 14.5 sen and YNH Property Bhd slid 16 sen to 68.5 sen. TWL Holdings Bhd was flat at four sen and Sapura Energy Bhd was unchanged at five sen.

Meanwhile, Bursa Malaysia has suspended short selling under its Intraday Short Selling (IDSS) rule for Lotte Chemical Titan Holding Bhd as the last done price of the stock dropped more than 15%, or 15 sen from its reference price. In a filing with Bursa Malaysia, it said the short selling under the IDSS of the company will only be activated on Wednesday at 8.30am.

Lotte Chemical closed down 23 sen, or 15.75% to RM1.23 with 9.79 million shares traded.

On the index board, the FBM Emas Index dropped 23.34 points to 11,256.84, the FBMT 100 Index lost 19.11 points to 10,916.86, and the FBM 70 Index shed 26.98 points to 15,264.54.

The FBM Emas Shariah Index gave up 50.58 points to 11,280.85 while the FBM ACE Index lost 33.88 points to 4,785.30.

Sector-wise, the Financial Services Index edged up 8.09 points to 16,950.67, the Energy Index weakened by 4.38 points to 879.18 and the Property Index shed 2.83 points to 926.07. The Plantation Index lost 54.23 points to 7,208.37 and the Industrial Products and Services Index edged down 0.86 of a point to 174.02.

The Main Market volume declined to 2.39 billion units worth RM2.33 billion from 2.94 billion units worth RM2.68 billion on Monday. Warrant turnover dwindled to 597.32 million units valued at RM96.41 million versus 635.14 million units valued at RM97.47 million previously.

The ACE Market volume rose to 760.74 million shares worth RM208.97 million compared with Monday's 740.72 million shares worth RM201.17 million.

Consumer products and services counters accounted for 232.01 million shares traded on the Main Market, industrial products and services (522.65 million); construction (165.59 million); technology (113.09 million); SPAC (nil); financial services (141.36 million); property (606.21 million); plantation (26.85 million); REITs (22.33 million), closed/fund (24,500); energy (260.77 million); healthcare (70.86 million); telecommunications and media (44.21 million); transportation and logistics (40.03 million); and utilities (142.44 million).

Source: The Edge

Comments

Post a Comment