KUALA LUMPUR (Jan 22): Bursa Malaysia closed higher for the second consecutive day on Monday, thanks to bargain-hunting activities in selected heavyweights and small-cap stocks.

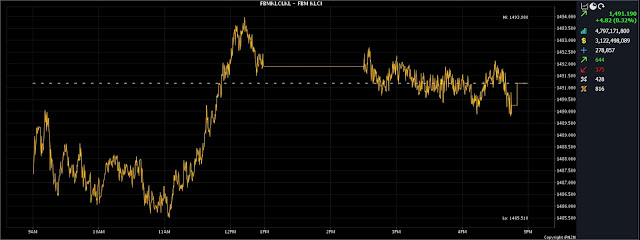

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) rose 4.82 points to 1,491.19 from last Friday's (Jan 19) close of 1,486.37.

The barometer index, which opened 0.98 of a point better at 1,487.35, moved between 1,485.51 and 1,493.98 throughout the session.

Buying in heavyweights was led by YTL Power International Bhd, which climbed 19 sen or 5.26% to RM3.80, followed by Axiata Group Bhd which soared 14 sen or 5.51% to RM2.68, while YTL Corp Bhd surged 11 sen or 5.05% to RM2.29. These three stocks contributed 6.681 points to the rise in the composite index.

In line with the upbeat momentum, the broader market saw advancers outpacing losers 644 to 375, while 428 counters were unchanged, 816 untraded and 15 others suspended.

Turnover dropped to 4.79 billion units worth RM3.12 billion from 5.39 billion units valued at RM2.73 billion on Friday.

Rakuten Trade equity research vice president Thong Pak Leng said the KLCI closed marginally higher as the "buying on dips" strategy continued following the recent sell-off.

The key regional indices, however, ended mostly lower due to the selling of real estate stocks in China and Hong Kong as investors were disappointed with the government's measures to stimulate the world's second-largest economy.

On the bright side, the US Federal Reserve (Fed) has hinted at the likelihood of rate cuts although some officials have signalled a potential delay compared to market expectations.

“On the domestic front, investors prefer to stay cautious due to the increasing global volatility and uncertainties.

“Hence, we reckon the FBM KLCI will stay in consolidation mode with an upside bias for the week, ranging between 1,480 and 1,500 points with immediate support at 1,475 and resistance at 1,500,” he said.

As for other heavyweights, Maybank Bhd eased two sen to RM9.01, Public Bank Bhd slipped a sen to RM4.34, CIMB Group Holdings Bhd shed four sen to RM5.97, Petronas Chemicals Group Bhd lost seven sen to RM6.71, while IHH Healthcare Bhd trimmed three sen to RM5.97.

Tenaga Nasional Bhd rose four sen to RM10.48, CelcomDigi Bhd gained three sen to RM5.97, while Hong Leong Bank Bhd soared 1.17% or 22 sen to RM19.02.

Of the actives, Sarawak Consolidated Industries Bhd jumped 14.5 sen to 43.5 sen, Widad Group Bhd bagged 2.5 sen to 13.5 sen, Leform Bhd added two sen to 18 sen, Jentayu Sustainables Bhd rose 4.5 sen to 54.5 sen, while Minetech Resourves Bhd shed a sen to 15.5 sen.

YNH Property Bhd hit limit down after falling 30 sen to end the day at 55.5 sen. It was the third most actively traded stock with 233.77 million shares changing hands.

This marked the third time that the stock hit limit down within the past two weeks.

On the index board, the FBM Emas Index increased 57.06 points to 11,122.22, the FBM 70 Index soared 110.41 points to 15,151.8, the FBMT 100 Index rose 46 points to 10,780.29, the FBM Emas Shariah Index advanced 62.03 points to 11,232.7, and the FBM ACE Index expanded 43.65 points to 4,833.8.

Sector-wise, the Financial Services Index improved 8.33 points to 16,621.85, the Property Index climbed 14.63 points to 905.6, the Industrial Products and Services Index edged up 0.51 of a point to 173.43, while the Energy Index perked up 11.03 points to 854.35.

However, the Plantation Index dipped 12.36 points to 7,150.73.

The Main Market volume declined to 3.03 billion units worth RM2.79 billion from 3.28 billion units valued at RM2.4 billion last Friday.

Warrants turnover swelled to 663.47 million units valued at RM98.55 million versus 530.55 million units valued at RM65.93 million previously.

The ACE Market volume slipped to 1.09 billion shares worth RM223.62 million compared with Friday’s 1.56 billion shares worth RM261.65 million.

Consumer products and services counters accounted for 323.48 million shares traded on the Main Market, industrial products and services (992.03 million); construction (231.47 million); technology (151.15 million); SPAC (nil); financial services (128.19 million); property (721.56 million); plantation (47.21 million); REITs (13.92 million), closed/fund (25,000); energy (138.39 million); healthcare (78.79 million); telecommunications and media (52.4 million); transportation and logistics (42.26 million); and utilities (107.36 million).

Source: The Edge

Comments

Post a Comment