KUALA LUMPUR (Dec 26): Bursa Malaysia ended lower on Tuesday amid muted trading as investors continued to stay on the sidelines due to the holiday-shortened week, a dealer said.

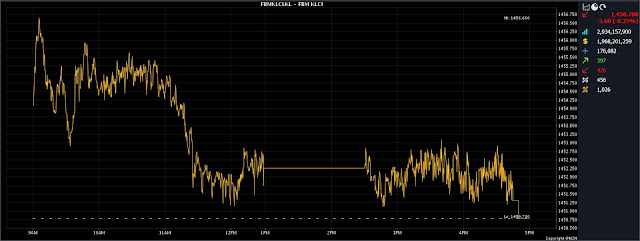

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) shed 3.6 points to end at its intraday low of 1,450.78 from Friday's (Dec 22) close of 1,454.38.

The KLCI opened 0.3 of a point easier at 1,454.08 and hit its day’s high of 1,456.66 thereafter before trending downwards towards closing.

In the broader market, losers outpaced gainers 454 to 376, while 447 counters were unchanged, 1,028 untraded and 15 others suspended.

Turnover eased to 2.91 billion units worth RM1.96 billion from 2.97 billion units worth RM1.84 billion on Friday

Apex Securities Bhd head of research Kenneth Leong said the local market was also dragged down by weakness in more than two-thirds of the key index constituents.

"Going forward, we expect the downward bias consolidation to persist in view of the lack of fresh leads,” he said.

"Given that market activities appear to be tepid, we reckon that any potential recovery will be limited for the time being. Still, we do not discount for any potential year-end window dressing in the final trading days of 2023," he said.

Meanwhile, Leong noted that investors would be keeping a close tab on Malaysia's producer price index data to be released on Wednesday.

Among the heavyweights, Maybank Bhd was flat at RM8.89, Tenaga Nasional Bhd added a sen to RM10, while Public Bank Bhd lost one sen to RM4.24, CIMB Group Holdings Bhd slipped two sen to RM5.78 and Petronas Chemicals Group Bhd dipped three sen to RM7.19.

Of the actives, Minetech Resources Bhd rose two sen to 15.5 sen, Sarawak Cable Industries Bhd climbed eight sen to 28 sen, while Mercury Securities Group Bhd slid eight sen to 55 sen, Bina Puri Holdings Bhd and Leform Bhd erased one sen to 8.5 sen and 41 sen, respectively.

On the index board, the FBM 70 Index went up 8.75 points to 14,625.59, the FBM ACE Index increased 2.77 points to 5,218.97, while the FBM Emas Shariah Index declined 5.04 points to 11,011.53, the FBM Emas Index slid 14.77 points to 10,805.15, and the FBMT 100 Index fell 17.75 points to 10,467.18.

Sector-wise, the Plantation Index dropped 38.32 points to 6,998.13, the Industrial Products and Services Index inched down 0.22 of a point to 172.54, the Financial Services Index slipped 55.64 points to 16,191.44, while the Property Index added 4.45 points to 863.92, and the Energy Index perked up 0.83 of a point to 819.43.

The Main Market volume expanded to 1.89 billion units valued at RM1.67 billion against 1.65 billion units valued at RM1.54 billion last Friday.

Warrants turnover tumbled to 116.57 million units worth RM12.84 million from 574.73 million units worth RM69.88 million previously.

The ACE Market volume swelled to 846.89 million shares valued at RM269.45 million versus 724.26 million shares valued at RM233.05 million on Friday.

Consumer products and services counters accounted for 237.84 million shares traded on the Main Market, industrial products and services (555.1 million); construction (207.07 million); technology (126.64 million); SPAC (nil); financial services (71.74 million); property (214.67 million); plantation (15.36 million); REITs (3.9 million), closed/fund (39,100); energy (137.15 million); healthcare (187.85 million); telecommunications and media (28.59 million); transportation and logistics (31.81 million); and utilities (67.84 million).

Source: The Edge

Comments

Post a Comment