KUALA LUMPUR (Dec 14): Bursa Malaysia closed on a positive note on Thursday, hitting an intraday high after taking signals from key regional indices, which were generally in the green following a positive cue from Wall Street overnight as the Federal Open Market Committee (FOMC) kept its interest rate steady.

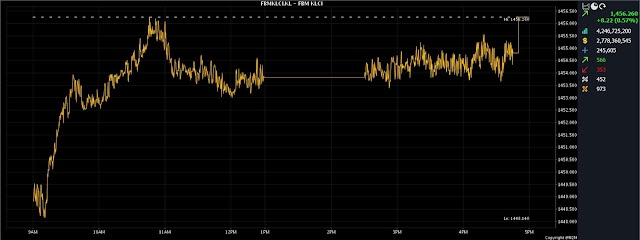

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) gained 0.57% or 8.22 points to 1,456.26 compared with Wednesday's closing of 1,448.04.

The key index opened 0.84 of a point better at 1,448.88 and moved between 1,448.14 and 1,456.26 throughout the day.

In the broader market, gainers thumped losers 567 to 352, while 452 counters were unchanged, 973 untraded, and 37 others suspended.

Turnover surged to 4.25 billion units worth RM2.78 billion from 3.76 billion units worth RM2.40 billion on Wednesday.

Rakuten Trade equity research vice-president Thong Pak Leng said the two primary takeaways from the two-day FOMC meeting were that interest rates remained steady and that the US Federal Reserve indicated it will begin decreasing interest rates next year, which sparked a rally on Wall Street, with the Dow Jones index finishing at a new high.

“With the rate cut in the US, we expect foreign funds to return to the region due to the attractive valuations of the regional markets and better economic growth. Hence, we expect Malaysia to benefit from the spillover effect, which will have a positive impact on the local market,” he told Bernama.

Thong added that with the renewed optimism, the FBM KLCI is anticipated to trend within the range of 1,455-1,465 towards the weekend.

Regionally, Hong Kong’s Hang Seng fell 1.07% to 16,402.19, Singapore’s Strait Times Index was 0.66% better at 3,124.65, South Korea’s Kospi added 1.34% to 2,544.18, however, Japan’s Nikkei 225 lost 0.73% to 32,686.25.

Among heavyweights, Malayan Banking Bhd was two sen lower at RM9.05 but Public Bank Bhd added four sen at RM4.30, CIMB Group Holdings Bhd gained two sen at RM5.81, Tenaga Nasional Bhd was nine sen better at RM9.97 and Petronas Chemicals Group Bhd was flat at RM7.15.

Of the actives, Sapura Energy Bhd was flat at five sen, Top Glove Corp Bhd added 3.5 sen at 91 sen, Velesto Energy Bhd increased one sen to 22.5 sen and SMTrack Bhd was one sen higher at five sen.

On the index board, the FBM Emas Index increased 73.89 points to 10,787.67, the FBMT 100 Index expanded 73.95 points to 10,454.97, the FBM Emas Shariah Index strengthened 89.02 points to 10,904.84,

The FBM 70 Index surged 166.89 points to 14,396.63 but the FBM ACE Index fell 11.49 points to 5,139.32.

Sector-wise, the Financial Services Index went up 55.80 points to 16,430.05 and the Energy Index was 14.90 points better at 804.23.

The Industrial Products and Services Index added 0.99 of-a-point to 171.73 and the Plantation Index was 7.25 points better at 7,000.82.

The Main Market volume expanded to 2.67 billion units valued at 2.42 billion against 2.49 billion units valued at RM2.13 billion on Wednesday.

Warrants turnover edged up to 790.68 million units worth RM121.04 million from 644.97 million units worth RM82.56 million previously.

The ACE Market volume improved to 784.15 million shares valued at RM233.96 million versus 617.69 million shares valued at RM187.42 million on Wednesday.

Consumer products and services counters accounted for 327.83 million shares traded on the Main Market, industrial products and services (603.53 million), construction (196.38 million), technology (143.96 million), SPAC (nil), financial services (73.69 million), property (279.1 million), plantation (38.18 million), REITs (17.15 million), closed/fund (9,800), energy (473.19 million), healthcare (357.06 million), telecommunications and media (24.02 million), transportation and logistics (38.99 million), and utilities (98.46 million).

Source: The Edge

Comments

Post a Comment