KUALA LUMPUR (Dec 22): Bursa Malaysia ended marginally lower on Friday in a relatively quiet market ahead of the long weekend, with selling primarily observed in banking, gaming, and plantation stocks.

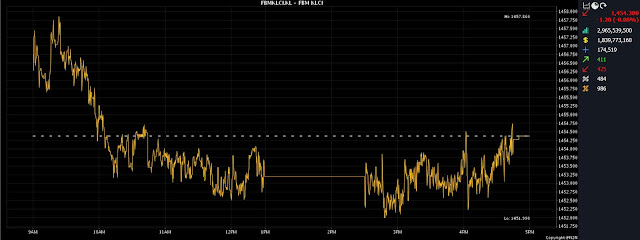

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) dipped 1.2 points to 1,454.38 from Thursday’s close of 1,455.58.

The KLCI opened 1.18 points firmer at 1,456.76 and moved between 1,451.99 and 1,457.86 throughout the day.

In the broader market, losers outpaced gainers 425 to 411, while 484 counters were unchanged, 986 untraded and 12 others suspended.

Turnover fell to 2.97 billion units worth RM1.84 billion from 3.06 billion units worth RM2.09 billion the previous day.

Rakuten Trade equity research vice president Thong Pak Leng said the key regional indices trended mixed on quiet trading sessions ahead of the Christmas and New Year holidays.

"Simultaneously, investors are looking ahead to 2024 as a year of potential rate cuts in the United States.

"In Hong Kong, stocks finished lower as heavyweights Tencent and NetEase reacted negatively after China released draft rules to curb excessive gaming and spending," he said.

Back home, Thong believed the recent sell-off provided opportunities for bargain hunters to accumulate stocks at lower levels.

"Furthermore, the benchmark index is currently trading at a forward 2024 price-earnings ratio of below 14 times, compared with its five-year average of 17 times, indicating more upside potential," he added.

Among the heavyweights, Petronas Chemicals Group Bhd gained one sen to RM7.22, Public Bank Bhd lost two sen to RM4.25, Tenaga Nasional Bhd erased one sen to RM9.99, while Maybank Bhd and CIMB Group Holdings Bhd were flat at RM8.89 and RM5.80, respectively.

Of the actives, Classita Holdings Bhd, Leform Bhd and Widad Group Bhd edged up half a sen each to five sen, 42 sen and 47 sen, respectively, Sarawak Consolidated Industries Bhd perked up 1.5 sen to 89 sen, while Top Glove Corp Bhd eased one sen to 92.5 sen.

On the index board, the FBM 70 Index climbed 30.32 points to 14,616.84, the FBM Emas Shariah Index advanced 13.47 points to 11,003.1, the FBM Emas Index inched up 1.20 points to 10,819.92, while the FBM ACE Index declined 10.38 points to 5,216.2, and the FBMT 100 Index shed 0.90 of a point to 10,484.93.

Sector-wise, the Plantation Index rose 4.25 points to 7,036.45, the Property Index added 1.54 points to 859.47, the Industrial Products and Services Index perked up 0.65 of a point to 172.76, the Energy Index put on 0.58 of a point to 818.6, while the Financial Services Index slipped 20.98 points to 16,247.09.

The Main Market volume declined to 1.65 billion units valued at RM1.54 billion against 1.81 billion units valued at RM1.84 billion on Thursday.

Warrants turnover expanded to 574.73 million units worth RM69.88 million from 427.1 million units worth RM46.48 million previously.

The ACE Market volume narrowed to 724.26 million shares valued at RM233.05 million versus 727.32 million shares valued at RM208.39 million the day before.

Consumer products and services counters accounted for 336.23 million shares traded on the Main Market, industrial products and services (430.44 million); construction (83.52 million); technology (150.98 million); SPAC (nil); financial services (67.62 million); property (220.93 million); plantation (12.65 million); REITs (5.04 million), closed/fund (6,900); energy (100.53 million); healthcare (120.7 million); telecommunications and media (30.44 million); transportation and logistics (24.44 million); and utilities (70.51 million).

Source: The Edge

Comments

Post a Comment