KUALA LUMPUR (Aug 18): Bursa Malaysia extended Thursday's (Aug 17) losses to close slightly lower on Friday on continued profit-taking from selected financial services as well as industrial products and services counters, in line with the weaker sentiment on regional bourses.

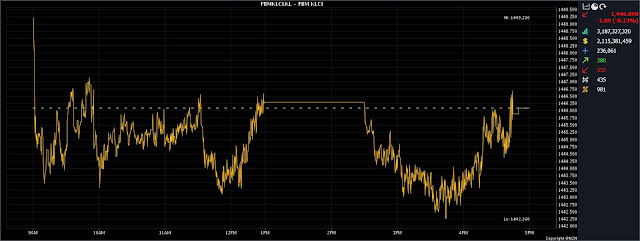

At 5pm, the FBM KLCI had slipped 1.89 points to 1,446.09, from 1,447.98 at Thursday’s close.

The barometer index opened 1.25 points better at 1,449.23, its intraday high, and hit a low of 1,442.26 in the mid-afternoon session.

Turnover declined to 3.19 billion units worth RM2.12 billion, from 4.34 billion units worth RM2.56 billion on Thursday.

CIMB Group Holdings Bhd and Press Metal Aluminium Holdings Bhd were the top two contributors to the local benchmark index’s losses, with a combined contribution of 2.93 points.

The banking group slipped nine sen to RM5.55 a share. Press Metal, meanwhile, dropped 10 sen to RM4.75.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said the KLCI ended slightly lower in tandem with the regional selldown.

“Regionally, key indices trended lower, following the negative cue from Wall Street overnight, as investors were worried about [further] US rate hikes and feared a potential property catastrophe in China.

“On the domestic front, sentiment may remain cautious in view of increasing market risks and volatility in global markets,” he told Bernama on Friday.

Among other heavyweights, Malayan Banking Bhd (Maybank) rose three sen to RM9.00, Petronas Chemicals Group Bhd went up one sen to RM6.80, IHH Healthcare Bhd improved five sen to RM6.00, while Public Bank Bhd slipped three sen to RM4.13, and Tenaga Nasional Bhd was flat at RM9.95.

Among the actives, Hong Seng Consolidated Bhd at six sen and Aimflex Bhd at 21.5 sen had eased half a sen each, UEM Sunrise Bhd shed one sen to 62 sen, Parkson Holdings Bhd gained 7.5 sen to 29.5 sen, and KNM Group Bhd rose two sen to 9.5 sen.

On the index board, the FBM Emas Index was 18.01 points lower at 10,661.56, the FBMT 100 Index dipped 17.13 points to 10,347.53, the FBM Emas Shariah Index lost 3.91 points to 10,873.51, the FBM 70 Index erased 38.73 points to 14,099.52, and the FBM ACE Index was 49.40 points lower at 5,264.14.

Sector-wise, the Financial Services Index dropped 39.36 points to 16,254.10, the Industrial Products and Services Index eased 0.40 of a point to 167.27, while the Plantation Index advanced 74.94 points to 6,985.80, and the Energy Index edged up 0.39 of a point to 815.26.

The Main Market volume slid to 2.30 billion units valued at RM1.88 billion, from 3.18 billion units valued at RM2.27 billion on Thursday.

Warrant turnover slipped to 359.69 million units worth RM48.86 million, versus Thursday's 398.44 million units worth RM60.76 million.

The ACE Market volume tumbled to 524.22 million shares valued at RM182.18 million, compared with 753.73 million shares valued at RM227.91 million previously.

Consumer products and services counters accounted for 475.66 million shares traded on the Main Market, along with industrial products and services (408.89 million), construction (187.20 million), technology (336.03 million), special purpose acquisition companies (nil), financial services (89.67 million), property (394.36 million), plantation (56.34 million), real estate investment trusts (14.28 million), closed/funds (204,000), energy (186.66 million), healthcare (33.02 million), telecommunications and media (21.99 million), transportation and logistics (43.55 million), and utilities (53.51 million).

Source: The Edge

Comments

Post a Comment