KUALA LUMPUR (Aug 25): Bursa Malaysia ended the week lower, in tandem with most regional markets, ahead of a speech from US Federal Reserve (Fed) chair Jerome Powell at the Jackson Hole Symposium later on Friday (Aug 25).

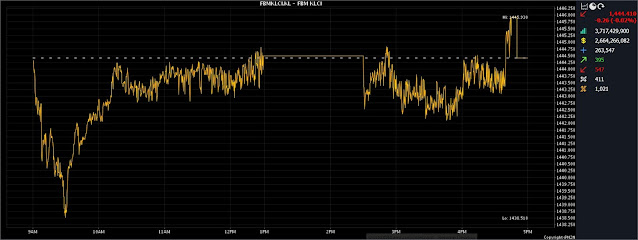

At 5pm, the FBM KLCI had shaved 0.26 of a point to 1,444.41, from 1,444.67 at Thursday's close.

The barometer index opened 0.46 point weaker at 1,444.21, and moved between 1,438.51 and 1,445.93 throughout the day.

On the broader market, decliners outpaced gainers 547 to 395, while 411 counters were unchanged, 1,021 untraded, and 23 others suspended.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said the KLCI pared losses at the close due to late buying, but the benchmark index still ended in the red amid the regional selldown.

"Key regional indices trended lower, following a negative performance on Wall Street overnight, with technology shares fizzling out, as the sentiment turned risk-averse ahead of Friday’s speech from Powell at the Jackson Hole Symposium.

"At the same time, China's dwindling housing market and slow consumer expenditure are impacting the investing outlook,” he told Bernama.

Regionally, Singapore's Straits Times Index bucked the trend and rose 0.22% to 3,187.82, but Japan's Nikkei 225 Index lost 2.05% to 31,624.28, and Hong Kong's Hang Seng Index fell 1.40% to 17,956.38.

South Korea's Kospi Composite Index declined 0.73% to 2,519.14.

Bursa heavyweights Malayan Banking Bhd (Maybank) added one sen to RM9.02, CIMB Group Holdings Bhd rose three sen to RM5.61, and Petronas Chemicals Group Bhd gained five sen to RM6.90.

IHH Healthcare Bhd added two sen to RM5.97, Public Bank Bhd was flat at RM4.08, and Tenaga Nasional Bhd slid three sen to RM9.97.

Among the actives, Boustead Plantations Bhd jumped 12 sen to RM1.49, Iskandar Waterfront City Bhd rallied 11 sen to 59.5 sen, and Ekovest Bhd was 2.5 sen higher at 45.5 sen.

UEM Sunrise Bhd expanded 4.5 sen to 67 sen, and RGB International Bhd dropped 1.5 sen to 36 sen.

On the index board, the FBM Emas Index eased 6.31 points to 10,662.27, the FBMT100 Index fell 6.88 points to 10,343.21, and the FBM Emas Shariah Index gave up 22.78 points to 10,888.97.

The FBM 70 Index lost 30.42 points to 14,126.31, and the FBM ACE Index discounted 39.88 points to 5,274.90.

Sector-wise, the Financial Services Index rose 3.75 points to 16,190.69, the Industrial Products and Services Index edged up 0.19 of a point to 169.03, and the Energy Index grew 0.43 of a point to 824.15.

The Plantation Index went down by 39.49 points to 6,958.83.

The Main Market volume went up to 2.54 billion units worth RM2.41 billion, from Thursday's 2.36 billion units worth RM1.60 billion.

Warrant turnover swelled to 440.69 million units worth RM58.93 million, against 420.48 million units worth RM65.37 million a day earlier.

The ACE Market volume eased to 723.48 million shares worth RM198.39 million, from 746.82 million shares worth RM240.07 million previously.

Consumer products and services counters accounted for 504.08 million shares traded on the Main Market, along with industrial products and services (401.71 million), construction (234.90 million), technology (162.77 million), special purpose acquisition companies (nil), financial services (55.56 million), property (501.68 million), plantation (150.96 million), real estate investment trusts (6.21 million), closed/funds (81,100), energy (235.91 million), healthcare (41.43 million), telecommunications and media (32.37 million), transportation and logistics (58.71 million), and utilities (153.37 million).

Source: The Edge

Comments

Post a Comment