KUALA LUMPUR (Aug 23): Bursa Malaysia ended broadly lower on Wednesday (Aug 23), with the key index dipping by 0.79% amid brisk selling activities in index-linked stocks led by Petronas Chemicals Group Bhd and Public Bank Bhd.

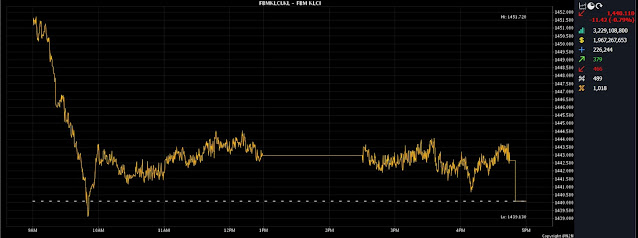

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) slipped 11.42 points to 1,440.11 from 1,451.53 at Tuesday's (Aug 22) close.

The barometer index opened 0.1 of a point better at 1,451.63, and moved between 1,439.13 and 1,451.72 throughout the trading day.

On the broader market, losers beat gainers 466 to 379 while 489 counters were unchanged, 1,018 untraded and 12 others suspended.

Turnover eased to 3.23 billion units worth RM1.97 billion from 3.31 billion units worth RM1.93 billion on Tuesday.

SPI Asset Management managing partner Stephen Innes said the weakness in the local bourse was weighed down mainly on the China factor, as investors remain concerned about the regional economic growth, as “when China sneezes, Asean markets tend to catch the cold”.

"This differs from the US market, which is rallying due to articial intelligence innovations, and as growth continues to hold up. Because of the potential financial instability concerns in China, its muting flows into regional equity markets,” he said.

In July, it was reported that China’s economy officially slipped into deflation for the first time in two years as consumer prices fell 0.3%.

Last Monday, the People's Bank of China cut one of its key interest rates for the second time in three months.

China's central bank lowered its one-year loan prime rate to 3.45% from 3.55%. However, this was considered disappointing as the market had expected a bigger rate cut, prompting a economic growth cut for the world's second-largest economy.

Of the heavyweights, Petronas Chemicals Group Bhd lost 21 sen to RM6.80, Public Bank Bhd fell five sen to RM4.08, IHH Healthcare Bhd and IOI Corp Bhd shed eight sen each to RM5.92 and RM3.97, respectively, while Press Metal Aluminium Holdings Bhd went down six sen to RM4.84, and Sime Darby Bhd eased seven sen to RM4.32.

Among the actives, Perdana Petroleum Bhd advanced five sen to 23.5 sen, Parkson Holdings Bhd bagged 4.5 sen to 36.5 sen, MyEG Services Bhd edged up half-a-sen to 80.5 sen, Widad Group Bhd was flat at 44 sen, and Bahvest Resources Bhd slipped five sen to 31.5 sen.

On the index board, the FBM Emas Index was 62.08 points weaker at 10,635.9, the FBMT 100 Index decreased 65.08 points to 10,318.78, the FBM Emas Shariah Index gave up 73.38 points to 10,859.79, the FBM 70 Index declined 18.41 points to 14,119.57, and the FBM ACE Index inched down 0.42 of a point to 5,285.14.

Sector-wise, the Financial Services Index dipped 85.24 points to 16,182.99, the Industrial Products and Services Index eased 1.76 points to 168.35, the Plantation Index fell 67.52 points to 6,963.08, and the Energy Index improved by 12.51 points to 823.78.

The Main Market volume slid to 2.16 billion units worth RM1.7 billion from 2.33 billion units worth RM1.69 billion on Tuesday.

Warrants turnover slipped to 364.58 million units worth RM46.19 million from 384.64 million units worth RM53.83 million on Tuesday.

The ACE Market volume tumbled to 364.58 million shares worth RM46.19 million from Tuesday's 582.76 million shares worth RM189.06 million.

Consumer products and services counters accounted for 451.72 million shares traded on the Main Market, industrial products and services (3.83 million); construction (97.73 million); technology (202.10 million); SPAC (nil); financial services (83.94 million); property (296.88 million); plantation (62.91 million); REITs (6.08 million), closed/fund (53,500); energy (420.83 million); healthcare (33.6 million); telecommunications and media (39.61 million); transportation and logistics (35.59 million); and utilities (44.42 million).

Source: The Edge

Comments

Post a Comment