KUALA LUMPUR (Sept 21): Bursa Malaysia closed lower for the fourth consecutive day on Thursday, due to cautious sentiments within the regional economies, said an analyst.

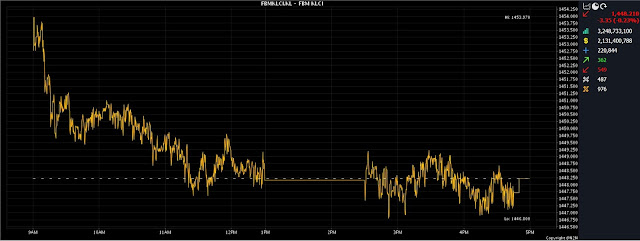

At 5pm, the FBM KLCI had fallen 3.35 points to 1,448.21, from Wednesday’s close at 1,451.56.

The index opened 1.21 points better at 1,452.77, and moved between 1,446.80 and 1,453.97 throughout the day.

The broader market was negative, with decliners leading advancers 549 to 362, while 487 counters were unchanged, 976 untraded, and 11 others suspended.

Turnover declined to 3.25 billion units worth RM2.13 billion, from 3.56 billion units worth RM2.51 billion on Wednesday.

SPI Asset Management managing director Stephen Innes said key regional indices were in the red on Thursday, following the US Federal Reserve’s hawkish stance.

“Global markets think US yields could push higher. So, as the day wore on, the narrative has shifted back to the most precarious dynamics for global stock markets as US interest rates are making fresh highs, which impinges on Asian markets like Bursa,” he told Bernama.

At Thursday's close, Japan’s Nikkei 225 had fallen 1.37% to 32,571.03, South Korea’s Kospi dropped 1.75% to 2,514.97, and Hong Kong’s Hang Seng Index shed 1.29% to 17,655.41.

Singapore’s Straits Times Index slid 1.12% to 3,205.53, and China’s SSE Composite Index contracted 0.77% to 3,084.70.

Bursa heavyweight counters Malayan Banking Bhd (Maybank) added four sen to RM8.90, Public Bank Bhd gained two sen to RM4.21, and Petronas Chemicals Group Bhd put on one sen to RM7.31.

Meanwhile, CIMB Group Holdings Bhd slid three sen to RM5.59, and Tenaga Nasional Bhd weakened six sen to RM10.06.

Of the actives, UEM Sunrise Bhd was three sen easier at 88 sen, and Top Glove Corp Bhd inched down 2.5 sen to 80.5 sen, while TWL Holdings Bhd at three sen, KNM Group Bhd at 12 sen, and EA Holdings Bhd at half a sen were all flat.

On the index board, the FBM Emas Index shed 28.40 points to 10,726.64, the FBMT 100 Index slipped 28.54 points to 10,392.01, the FBM 70 Index inched down 58.72 points to 14,287.56, and the FBM Emas Shariah Index fell 45.99 points to 10,972.47.

Meanwhile, the FBM ACE Index improved by 10.01 points to 5,214.14.

Sector-wise, the Plantation Index went down 53.61 points to 6,925.10, and the Energy Index eased 12.24 points to 891.89, while the Industrial Products Services Index was flat at 174.41, and the Financial Services Index climbed 9.58 points to 16,227.97.

The Main Market volume fell to 2.14 billion units worth RM1.90 billion, from 2.49 billion units worth RM2.23 billion on Wednesday.

Warrant turnover reduced to 379.14 million units valued at RM48.82 million, against 395.36 million units valued at RM53.57 million previously.

The ACE Market volume widened to 690.76 million shares worth RM182.43 million, from 662.20 million shares worth RM224.11 million previously.

Consumer products and services counters accounted for 300.90 million shares traded on the Main Market, along with industrial products and services (410.63 million), construction (153.56 million), technology (135.60 million), special purpose acquisition companies (nil), financial services (66.41 million), property (540.99 million), plantation (39.22 million), real estate investment trusts (3.78 million), closed/funds (9,000), energy (238.65 million), healthcare (131.50 million), telecommunications and media (28.18 million), transportation and logistics (41.36 million), and utilities (46.13 million).

Source: The Edge

Comments

Post a Comment