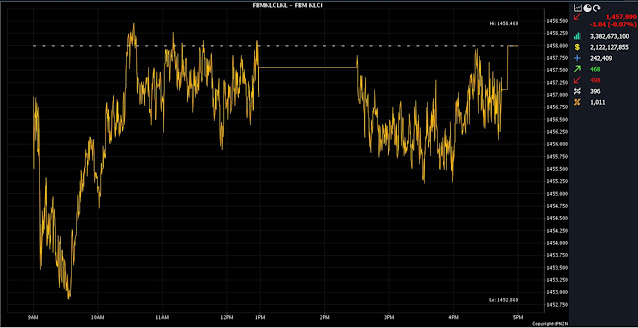

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) fell 1.04 points to 1,457.99 from last Friday’s closing of 1,459.03.

The barometer index opened 2.07 points lower at 1,456.96 and moved between 1,452.86 and 1,458.46 throughout the day.

The broader market was weaker with losers outpacing gainers 498 to 468, while 396 counters were unchanged, 1,011 untraded and 23 others suspended.

Turnover decreased to 3.38 billion units worth RM2.12 billion from 4.02 billion units worth RM4.31 billion last Friday.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said most key regional indices were also in the negative territory as investors are watching central banks closely for their decisions on policy rates.

The People's Bank of China (PBOC) is scheduled to decide on its key loan prime rates on Wednesday (Sept 20), while the Bank of Japan (BOJ) is scheduled to hold its meeting on Friday (Sept 22).

“The prevailing market consensus is that these central banks will probably keep the rates at their existing record low.

“As for the local bourse, we believe today's selldown provides opportunities for investors to embark on bargain hunting, particularly oil and gas stocks," he told Bernama.

Hence, Thong anticipates the KLCI to trend within the 1,450-1,465 range for the week.

From the technical point of view, the benchmark index has formed a new support level at 1,445 from 1,440 previously, while resistance remains unchanged at 1,465, he said.

At the close, Bursa heavyweights Maybank Bhd added two sen to RM8.93, Public Bank Bhd inched up one sen to RM4.20 and Tenaga Nasional Bhd added eight sen to RM10.14, while CIMB Group Holdings Bhd lost two sen to RM5.76 and Petronas Chemicals Group Bhd slipped 16 sen to RM7.27.

Of the actives, Icon Offshore Bhd and Malaysian Resources Corp Bhd inched up a sen each to 11.5 sen and 46.5 sen, respectively, and UEM Sunrise Bhd climbed 11.5 sen to 84.5 sen.

Meanwhile, Ekovest Bhd and Classita Holdings Bhd eased half a sen each to 54.5 sen and 6.5 sen, respectively.

On the index board, the FBM Emas Index slipped 8.85 points to 10,762.32,

the FBMT 100 Index slid 10.15 points to 10,434.64, the FBM 70 Index

shed 25.83 points to 14,226, the FBM Emas Shariah Index eased 15.71

points to 10,995.64 and the FBM ACE Index weakened 20.06 points to

5,189.44.

Sector-wise, the Energy Index inched down 1.32 points to 892.54, the Plantation Index decreased 59.61 points to 6,977.6, and the Industrial Products Services Index erased 1.54 points to 172.94.

Meanwhile, the Financial Services Index was 10.81 points higher at 16,341.04.

The Main Market’s volume slumped to 2.34 billion units worth RM1.9 billion from 3.02 billion units worth RM4.08 billion last Friday.

Warrant turnover reduced to 389.64 million units valued at RM51.71 million against 464.07 million units valued at RM68.52 million previously.

However, the ACE Market volume improved to 575.09 million shares worth RM166.77 million from 536.34 million shares worth RM159.08 million previously.

Consumer products and services counters accounted for 389.49 million shares traded on the Main Market, industrial products and services (438.49 million); construction (165.15 million); technology (169.02 million); SPAC (nil); financial services (43.78 million); property (479.84 million); plantation (100.68 million); REITs (12.24 million), closed/fund (15,600); energy (340.78 million); healthcare (51.83 million); telecommunications and media (26.4 million); transportation and logistics (52.95 million); and utilities (68.04 million).

Source: The Edge

Comments

Post a Comment