KUALA LUMPUR, May 14 (Bernama) -- Bursa Malaysia closed higher today, driven by increased daily trading volume indicating rising interest in Malaysian equities, particularly from foreign buyers, a dealer said.

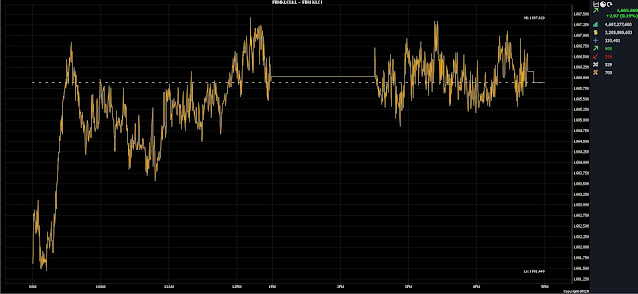

At 5 pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) gained 2.97 points to 1,605.88, compared to yesterday’s close of 1,602.91.

The benchmark index opened 1.04 points lower at 1,601.62 and moved between 1,601.44 and 1,607.42 throughout the session.

Advancers outnumbered decliners 592 to 527 across the broader market, with 520 counters unchanged, 706 untraded, and nine others suspended.

Turnover improved to 4.69 billion units worth RM3.19 billion from 4.53 billion units worth RM3.01 billion on Monday.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said the FBM KLCI advanced further as foreign buying continues, particularly in energy, telecommunications and plantation stocks.

“Consequently, we maintain our weekly FBM KLCI target between 1,600 and 1,620, with immediate resistance at 1,615 and support at 1,600, followed by 1,585,” he told Bernama.

As for regional markets, Thong said that key regional indices saw minimal changes as investors preferred to stay cautious ahead of this week's release of crucial US inflation data, expected to influence the outlook for US interest rates significantly.

The data is scheduled for Wednesday, with expectations indicating a slowdown in the core Consumer Price Index from an annual rate of 3.6 per cent for April compared with 3.8 per cent in March.

Meanwhile, UOB Kay Hian Wealth Advisors head of investment research Mohd Sedek Jantan said the FBM KLCI ended slightly higher today amidst a week packed with economic releases while investors continue to exercise caution ahead of key economic data releases, including the US April Producer Price Index (PPI) report scheduled for Tuesday, followed by the CPI.

“Furthermore, attention will be on Friday's release of Bank Negara Malaysia's GDP figures for the first quarter of 2024.

“Nonetheless, we believe the market undertone remains solid as the accumulation of stocks continues, supported by recent high-profile investments announced by multinationals, strengthening local political stability, and a gradual rollout of economic and fiscal reform initiatives to facilitate long-term growth and competitiveness,” he said.

Mohd Sedek said the index is expected to range between 1,600 and 1,614 this week, with any breach of these limits likely prompting further movement.

"Support levels remain steady at 1,575 and 1,560, while resistance is expected at 1,614 and 1,635," he added.

Among gainers in the heavyweights, YTL Corporation rose 13 sen to RM3.52, YTL Power gained 12 sen to RM5.04, while Maybank improved one sen to RM9.88. However, Public Bank and CIMB lost one sen each to RM4.17 and RM6.79, respectively.

As for the actives, MMAG shares lost half a sen to 37 sen, its warrant was 2.5 sen easier at 13 sen, ACE-market debutante Farm Price’s shares jumped 70.83 per cent to 41 sen from the opening price of 24 sen, Pan Malaysia added four sen to 32.5 sen, while Sapura Energy was flat at 4.5 sen.

On the index board, the FBM Emas Index added 18.83 points to 12,137.13, the FBMT 100 Index rose 17.20 points to 11,741.17, and the FBM Emas Shariah Index gained 23.38 points to 12,332.34.

The FBM 70 Index advanced 6.24 points to 17,048.24, while the FBM ACE Index climbed 56.92 points to 5,324.41.

Sector-wise, the Financial Services Index lost 24.56 points, settling at 17,531.08. Conversely, the Industrial Products and Services Index edged up 0.80 of-a-point to 193.46.

The Plantation Index rose 10.42 points to 7,434.59, and the Energy Index accumulated 8.02 points to 985.87.

The Main Market volume narrowed to 2.49 billion units worth RM2.62 billion from 2.53 billion units worth RM2.55 billion yesterday.

Warrants turnover fell to 997.69 million units valued at RM167.0 million from Monday’s closing of 1.11 billion units valued at RM155.54 million.

The ACE Market volume widened to 1.2 billion shares worth RM397.07 million from 884.03 million shares valued at RM298.12 million.

Consumer products and services counters accounted for 545.0 million shares traded on the Main Market, industrial products and services (419.30 million), construction (257.03 million), technology (260.72 million), SPAC (nil), financial services (75.23 million), property (338.35 million), plantation (24.17 million), REITs (12.5 million), closed/fund (73,100), energy (218.58 million), healthcare (100.6 million), telecommunications and media (35.53 million), transportation and logistics (119.94 million), utilities (84.4 million), and business trusts (221,900).

Source: Bernama

Comments

Post a Comment