KUALA LUMPUR (Nov 9): Bursa Malaysia ended lower for the third consecutive day on Thursday, tracking the downbeat performance by regional peers as market sentiments turned cautious ahead of the US Federal Reserve’s (Fed) monetary policy decision later in the day.

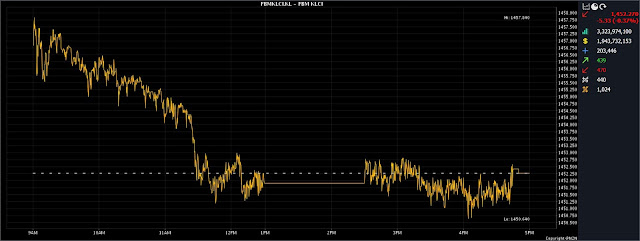

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) fell by 0.36%, or 5.33 points to close at 1,452.27 from Wednesday's closing of 1,457.6.

The index opened 0.76 of a point easier at 1,456.84 and moved between 1,450.64 and 1,457.84 throughout the day.

The broader market was negative as decliners outpaced gainers 470 to 439, while 440 counters were unchanged, 1,024 untraded and 20 others suspended.

Turnover narrowed to 3.32 billion units valued at RM1.94 billion from Wednesday’s 3.45 billion units worth RM1.97 billion.

Apex Securities Bhd head of research Kenneth Leong said the KLCI extended its decline as investors brushed off the strong retail sales data which recorded a 6.5% year-on-year rise in September 2023.

He said sentiment remains jittery as investors await further guidance on the US’ interest rate policy direction from several key Fed officials.

“Looking ahead, we expect consolidation to take place as investors may turn to the sidelines ahead of the extended weekend due to the Deepavali festive break,” he said.

Among the heavyweights, Maybank Bhd and Public Bank Bhd were flat at RM9.12 and RM4.21, respectively, while CIMB Group Holdings Bhd added one sen to RM5.78, Petronas Chemicals Group Bhd lost 11 sen to RM7.20 and Tenaga Nasional Bhd fell two sen to RM9.90.

Of the actives, Velesto Energy Bhd was half a sen weaker at 25 sen and Kanger International Bhd slipped a sen to 8.5 sen, while PDZ Holdings Bhd and Sarawak Consolidated Industries Bhd gained half a sen each to six sen and 59 sen, respectively, and Swift Haulage Bhd increased 1.5 sen to 56.5 sen.

On the index board, the FBM Emas Index trimmed 36.35 points to 10,743.03, the FBMT 100 Index shed 38.48 points to 10,404.57, the FBM Emas Shariah Index eased 53.55 points to 10,945.88 and the FBM 70 Index weakened 54.12 points to 14,232.49, while the FBM ACE Index gained 29.13 points to 5,159.23.

Sector-wise, the Industrial Products and Services Index went down 0.29 of a point to 173.12, the Plantation Index shed 32.97 points to 6,923.39, the Energy Index was 3.42 points weaker at 861.53 and the Financial Services Index reduced 4.73 points to 16,365.52.

The Main Market volume was marginally higher at 2.26 billion units worth RM1.71 billion compared with Wednesday’s 2.23 billion units worth RM1.71 billion.

Warrant turnover fell to 370.43 million units valued at RM53.15 million from 379.18 million units valued at RM56.94 million the day before.

The ACE Market volume decreased to 665.88 million shares worth RM178.7 million from 835.54 million shares worth RM209.59 million previously.

Consumer products and services counters accounted for 463.54 million shares traded on the Main Market, industrial products and services (561.78 million); construction (134.68 million); technology (121.07 million); SPAC (nil); financial services (44.18 million); property (180.39 million); plantation (23.76 million); REITs (7.01 million), closed/fund (9,500); energy (201.39 million); healthcare (92.72 million); telecommunications and media (40.68 million); transportation and logistics (237.9 million); and utilities (156.61 million).

Source: The Edge

Comments

Post a Comment