KUALA LUMPUR (Feb 28): Bursa Malaysia ended the last trading day of February with a paltry loss, after the key index swung between gains and losses, as investors seemed to trade cautiously ahead of the release of the purchasing managers indices (PMIs) in the US and China.

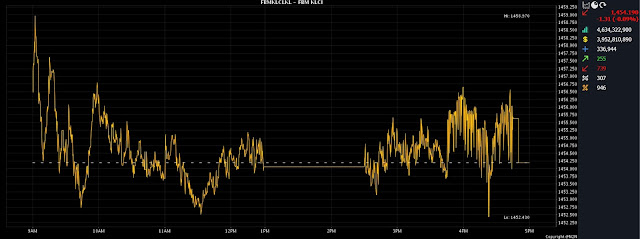

At 5pm on Tuesday (Feb 28), the benchmark FBM KLCI had fallen 1.31 points to 1,454.19, from Monday’s closing at 1,455.50.

The index opened 0.99 of a point higher at 1,456.49, and moved between 1,452.43 and 1,458.97 throughout the day.

Turnover, however, soared to 4.63 billion units worth RM3.95 billion, from Monday's 3.09 billion units worth RM2.19 billion.

Investors are awaiting US consumer confidence data, wholesale inventories, and the Chicago PMI on Tuesday night, and China's official February and Caixin manufacturing PMIs on Wednesday, for fresh clues about trajectories of the world's two largest economies.

Rakuten Trade Sdn Bhd vice-president of equity research Thong Pak Leng said the KLCI was stuck in consolidation mode due to a lack of clear direction among investors.

"The key regional indices were also in a similar pattern, as fears of rising US interest rates continued to batter regional sentiment.

"Additionally, investor sentiment was also weighed down by rising geopolitical tension, with US-China relations the dominant uncertainty at the forefront of investor minds," he told Bernama.

Sentiment on the Chinese equity market has turned hesitant over the republic's economic recovery, with investors now turning to the “two sessions” meeting in Beijing from Saturday in hopes of more policy stimulus.

Among the heavyweights at home, Tenaga Nasional Bhd fell 27 sen to RM9.37, Petronas Dagangan Bhd dipped 96 sen to RM21.02, Maxis Bhd was nine sen weaker at RM3.91, while Sime Darby Plantation Bhd at RM4.23 and Dialog Group Bhd at RM2.25 had dropped seven sen each.

CIMB Group Holdings Bhd climbed seven sen to RM5.61, while Malayan Banking Bhd (Maybank) rose five sen to RM8.80.

As for the active stocks, Velesto Energy Bhd lost 8.5 sen to 19 sen, Hartalega Holdings Bhd went down eight sen to RM1.47, Gamuda Bhd was flat at RM4.20, and Pharmaniaga Bhd tumbled 17 sen to 27 sen.

On the index board, the FBM Emas Index trimmed 26.12 points to 10,579.13, the FBMT 100 Index slid 6.68 points to 10,271.46, and the FBM ACE Index fell 178.44 points to 5,358.27.

The FBM Emas Shariah Index dropped 62.35 points to 10,797.67, and the FBM 70 Index put on 2.14 points to 13,436.63.

Sector-wise, the Financial Services Index gained 63.81 points to 16,194.83, the Energy Index declined 46.37 points to 843.57, the Plantation Index shed 2.80 points to 6,766.64, and the Industrial Products and Services Index eased 0.63 of a point to 177.43.

The Main Market volume surged to 3.56 billion shares worth RM3.64 billion, from Monday's 1.89 billion shares worth RM1.85 billion.

Warrant turnover shrank to 305.37 million units worth RM54.41 million, from 335.38 million units worth RM50.88 million on Monday.

The ACE Market volume dwindled to 764.19 million shares worth RM260.79 million, from 808.61 million shares worth RM283.14 million previously.

Consumer product and service counters accounted for 392.61 million shares traded on the Main Market, followed by industrial products and services (643.81 million), construction (264.81 million), technology (459.05 million), special purpose acquisition companies (nil), financial services (120.21 million), property (166 million), plantation (40.20 million), real estate investment trusts (10.44 million), closed/funds (9,000), energy (874 million), healthcare (410 million), telecommunications and media (60.58 million), transportation and logistics (65.39 million), and utilities (57.30 million).

Source: The Edge

Comments

Post a Comment