Anyway, due to the phone conversation, I know some of us are not aware that we can actually withdraw the money to the banks in Malaysia.

Below are the step by step on how to do it beginning from registering a bank account to the Paypal account.

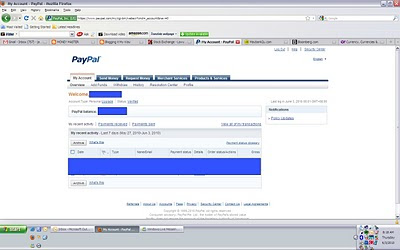

1. Login to your Paypal account. You should be getting something like the following screenshot.

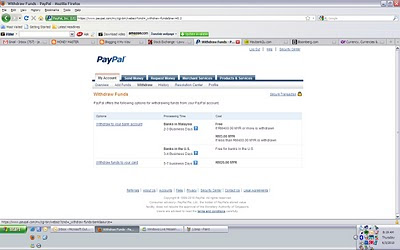

2. Next, click on the Withdraw tab and you will see that you can withdraw money either direct to the bank account and to debit card or credit card. Click on the Withdraw to your bank account link to withdraw direct to the bank account without any charges, provided the amount is more than RM400.

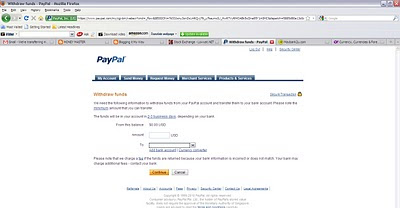

3. After you click on the Withdraw to your bank account link, you will be directed to the following page.

If one withdraw money from Paypal account for the first time, he or she will need to setup a bank account to the Paypal account. To do so, click on the Add bank account link on the page. You will be directed to the page as shown below after you click on the Add bank account link.

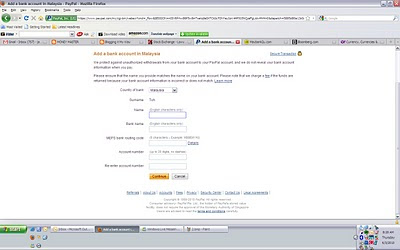

4. Fill in the details required in the setup bank correctly. The MEPS bank routing code is actually the Malaysia bank Swift code. Double check the details so that you will be getting the money instead of the money going here and there. Click continue once filling in all the details. Confirm the details and then repeat step 2 (this is my shortcut way of getting to the right page). This time you can enter the amount in USD and if you have only one bank setup to the account, it will appear in the To column. If you have more than one bank account setup, just choose the correct bank account. Click continue when done.

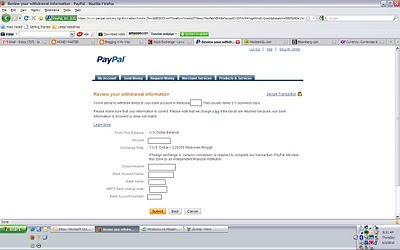

5. Review your withdrawal information and click Submit to confirm the withdrawal information.

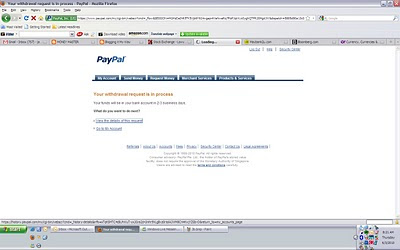

6. Finally, you will be directed to the following page stating that "Your funds will be in your bank account in 2-3 business days" as shown below. An email will be sent to your Paypal email account as well for your reference.

If I remember correctly, I always withdraw on Monday and get my money before Friday on the same week. Hope this helps.